North, West, Southern, and East Africa are attracting similar amounts of equity funding in 2023 so far

As of the end of August 2023, start-ups in Africa had raised $1.3bn in equity ($2.2bn if we add debt), 57% less than in the same period last year. As the size of the proverbial pie shrinks, one may wonder whether some regions are cutting themselves a bigger slice of it?

RELATED: Funding down for African startups inside the Big Four

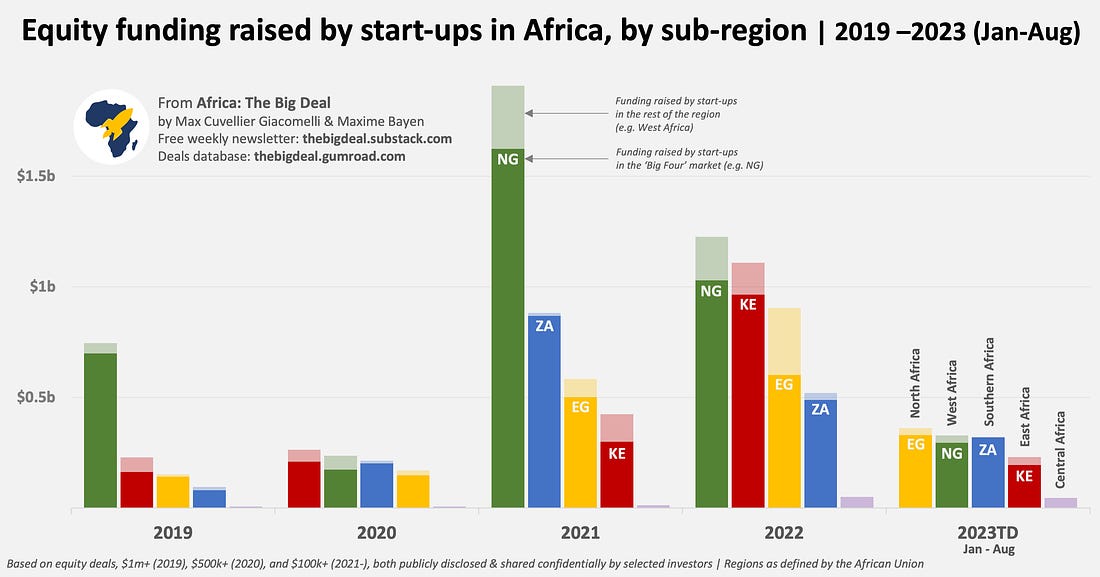

First of all, this is a fair question to ask, because it has definitely been the case in the past. If we look back at 2021, of the equity funding deployed to start-ups where we could pin down the HQ to a specific market/region (basically removing the Chipper Cash deals), 50% had gone to Western Africa. Actually, 42% of all the equity funding on the continent had gone to Nigeria alone.

Fast forward to 2023 (the first two thirds of the year, at least), the numbers are telling a very different story, one of balance between the four regions that have historically attracted 99% of the funding on the continent: North, West and Southern Africa has attracted very similar amounts of equity funding, roughly a quarter each. Only East Africa has a sightly smaller share of equity funding (18%), though this is somehow compensated by the fact that Kenya has been the country where most debt has been announced this year so far (nearly $400m, 50% of the total). While funding raised in Central Africa remains orders of magnitude smaller than in other regions, with 3.5% of the equity raised in Africa in 2023 so far, its share is much higher than it’s ever been since 2019 (below 1%, expect in 2022: 1.3%).

While we have focused on regional funding for this analysis, it is very clear from the graph that the four largest markets (Nigeria, South Africa, Egypt and Kenya) continue to attract the lion’s share of the funding. In fact, in 2023 so far start-ups in the Big Four have claimed 89% of the equity funding in Africa, an even higher percentage than in the past four years. The share of each Big Four market in the total funding raised in their respective region is also higher for each region compared to 2021 and 2022.

The full story can be found here: https://thebigdeal.substack.com/p/a-fairer-way-to-share-the-funding?utm_source=profile&utm_medium=reader2