A new report, Caution: Slippery Flow. How lower investment activity is impacting the Big Four by Africa: The Big Deal,shows a downward slide in the number of funding and deals entering the startup ecosystems in South Africa, Nigeria, Kenya and Egypt considered as the Big Four on the continent.

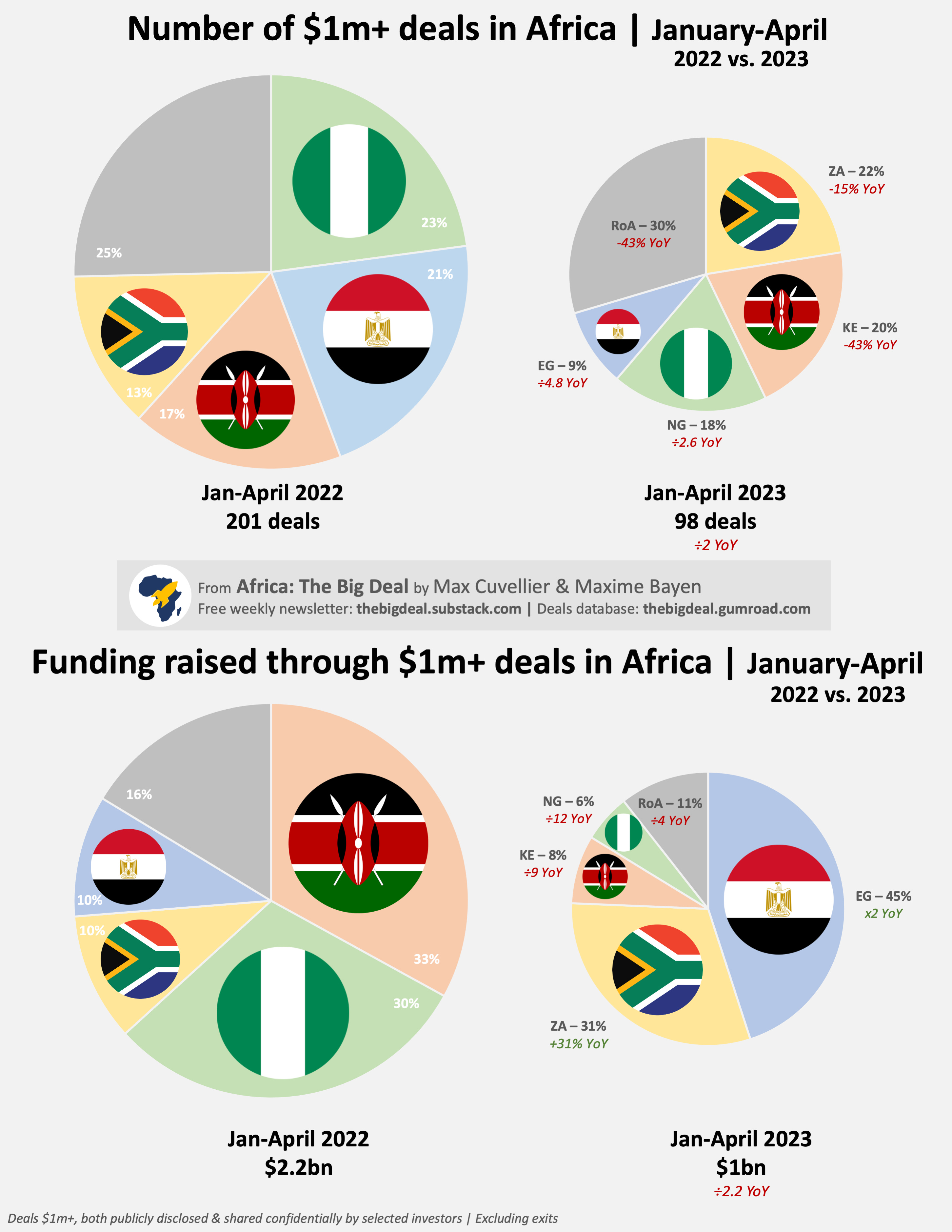

The report by Max Cuvellier notes: “Last week we covered the fact that both the number of $1m+ deals and the total amount raised through those deals (exc. exits) in 2023 so far (Jan-April) represent less than half of what they were during the same period back in 2022. And then we thought: are all countries feeling the heat – or the cold, rather – in the same way?

RELATED: African tech startups record $6.5B funding in 2022, 8% increase over 2021, spread across 764 deals – Partech reports

“As far as $1m+ deals are concerned, each of the Big Four is experiencing a YoY decline, but this ranges from a little step back for South Africa (-15% YoY) to a steeper decline in Kenya (-45%) and Nigeria (-61%) and a serious fall in Egypt (÷4.8). As a result, South Africa, which was bringing up the rear last year, is now technically leading with 22% of $1m+ deals in 2023 so far, though Nigeria and Kenya are at comparable levels (around 20 each). With only 9 $1m+ deals, Egypt lost ground YoY (from a 21% share to just 9%), while the share of ‘Rest of Africa’ grew slightly.

“If we look at deals $100k+ – therefore including smaller transactions – YoY trends are pretty similar. That said, Nigeria’s stronger lead in Jan-April 2022 (31% of all $100k+ deals then) means that the country is still leading in 2023 so far with 28% of $100k+ deals, followed by Kenya (23%) and South Africa (14%).”

Even then, the report reveals that South Africa appears to have taken the top spot in 2023 as the hottest destination for funding and deals. “The country actually accounts for almost half (9 out of 20) of $10m+ deals in 2023 so far.” In contrast, “funding in Kenya and Nigeria is about a tenth of what it was in the same period last year.”

The report notes: “Looking at the amount of funding raised through those $1m+ deals tells a slightly different story: funding in Egypt has doubled YoY, taking the country from fourth to first place. South Africa also registered good levels of growth (+31% YoY), taking second spot. Combined, Egypt and South Africa have attracted three quarters of the funding on the continent so far (vs. 20% in the same period last year).

“A caveat though: these numbers are heavily influenced by ‘mega deals’ ($100m+), which have been harder to come across in 2023 so far (only two so far: MNT-Halan in Egypt ($400m) and Planet42 in South Africa ($100m), both a mix of equity and debt), compared to 4 in the same period last year. A caveat in the caveat if I may: while the MNT-Halan deal represents 89% of the funding in Egypt, Planet42 is ‘only’ a third of the South African total, pointing to much healthier growth in South Africa. The country actually accounts for almost half (9 out of 20) of $10m+ deals in 2023 so far (vs. 10%, 5 out of 48, last year).

“In the meanwhile, funding in Kenya and Nigeria is about a tenth of what it was in the same period last year, making their share of the total tumble down from 33% and 30% to 8% and 6% respectively. The share of funding raised outside of the Big Four also shrank from 16% in Jan-April 2022 to 11% in 2023 so far (÷3.4 YoY in absolute terms).”

COVER IMAGE: AFD – Agence Française de Développement