- Data breaches, attacks on critical infrastructure or physical assets and increased ransomware attacks drive cyber concerns (36% of responses)

- Business interruption remains #2 with 31% of responses. Natural catastrophes is the biggest riser compared to 2023 with 26% in #3

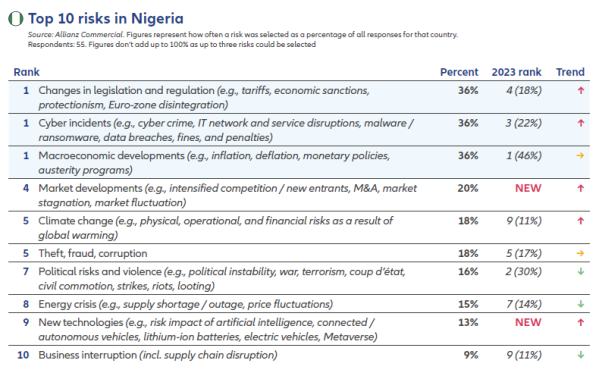

- Businesses in Nigeria concerned about regulatory, cyber, and economic risks

- Risk perception differs regionally for climate change, political risks and violence, and shortage of skilled workforce

Cyber incidents such as ransomware attacks, data breaches, and IT disruptions are the biggest worry for companies globally in 2024, according to the Allianz Risk Barometer. The closely interlinked peril of Business interruption ranks second. Natural catastrophes (up from #6 to #3 year-on-year), Fire, explosion (up from #9 to #6), and Political risks and violence (up from #10 to #8) are the biggest risers in the latest compilation of the top global business risks, based on the insights of more than 3,000 risk management professionals.

Businesses in Nigeria concerned about regulatory, cyber, and economic risks

In Nigeria, the report highlights the increasing worries surrounding Changes in legislation and regulation, Cyber incidents, and Macroeconomic developments, which have emerged as joint top risks with 36% of responses. Changes in legislation and regulation climbed up from the fourth position in 2023 to become one of the most pressing concerns for reflecting the evolving regulatory landscape and the need for companies to adapt to new policies and compliance requirements.

RELATED: Cybercrime the biggest risk to businesses in 2023; ahead of supply issues and inflation

Yomi Onifade, the Managing Director/Chief Executive Officer of Allianz Nigeria, stated, “The changing regulatory environment poses significant challenges for businesses in Nigeria. It is crucial for companies to stay updated and ensure compliance to mitigate potential risks.”

Cyber incidents have also risen in prominence, moving up from the third spot in 2023 with businesses recognizing the urgent need to enhance their cybersecurity measures to protect sensitive data and maintain operational continuity. Onifade emphasized, “With the increasing reliance on digital platforms, businesses must prioritize cybersecurity to safeguard their operations and customer information. Failure to do so can have severe consequences.”

Macroeconomic developments have maintained their position as a top risk, indicating the ongoing challenges faced by businesses in navigating economic uncertainties and volatility. Onifade added, “The Nigerian business landscape is constantly evolving, and companies must be prepared to adapt to changing economic conditions. A robust risk management strategy is essential to mitigate the impact of macroeconomic challenges.”

Allianz Commercial CEO Petros Papanikolaou comments on the findings: “The top risks and major risers in this year’s Allianz Risk Barometer reflect the big issues facing companies around the world right now – digitalization, climate change and an uncertain geopolitical environment. Many of these risks are already hitting home, with extreme weather, ransomware attacks and regional conflicts expected to test the resilience of supply chains and business models further in 2024. Brokers and customers of insurance companies should be aware and adjust their insurance covers accordingly.”

Large corporates, mid-size, and smaller businesses are united by the same risk concerns – they are all mostly worried about cyber, business interruption and natural catastrophes. However, the resilience gap between large and smaller companies is widening, as risk awareness among larger organizations has grown since the pandemic with a notable drive to upgrade resilience, the report notes. Conversely, smaller businesses often lack the time and resources to identify and effectively prepare for a wider range of risk scenarios and, as a result, take longer to get the business back up and running after an unexpected incident.

Trends driving cyber activity in 2024

Cyber incidents (36% of overall responses) rank as the most important risk globally for the third year in a row – for the first time by a clear margin (5% points). It is the top peril in 17 countries, including Nigeria, Uganda, Kenya, Mauritius, Australia, France, Germany, India, Japan, the UK, and the USA. A data breach is seen as the most concerning cyber threat for Allianz Risk Barometer respondents (59%) followed by attacks on critical infrastructure and physical assets (53%). The recent increase in ransomware attacks – 2023 saw a worrying resurgence in activity, with insurance claims activity up by more than 50% compared with 2022 – ranks third (53%).

“Cyber criminals are exploring ways to use new technologies such as generative artificial intelligence (AI) to automate and accelerate attacks, creating more effective malware and phishing. The growing number of incidents caused by poor cyber security, in mobile devices in particular, a shortage of millions of cyber security professionals, and the threat facing smaller companies because of their reliance on IT outsourcing are also expected to drive cyber activity in 2024, “explains Scott Sayce, Global Head of Cyber, Allianz Commercial.

Business interruption and natural catastrophes

Despite an easing of post-pandemic supply chain disruption in 2023, Business interruption (31%) retains its position as the second biggest threat in the 2024 survey. In Nigeria, Business interruption moved down from #9 to #10. It ranks in the top five risks in Africa and the Middle East, Ghana, Kenya, Senegal, South Africa, Uganda. This This result reflects the interconnectedness in an increasingly volatile global business environment, as well as a strong reliance on supply chains for critical products or services. Improving business continuity management, identifying supply chain bottlenecks, and developing alternative suppliers continue to be key risk management priorities for companies in 2024.

Natural catastrophes (26%) is one of the biggest movers at #3, up three positions. 2023 was a record-breaking year on several fronts. It was the hottest year since records began, while insured losses exceeded US$100bn for the fourth consecutive year, driven by the highest ever damage bill of US$60bn from severe thunderstorms. In Africa and the Middle East, natural catastrophes have emerged as a new risk, ranking at #6. Notably, Morocco witnessed a significant rise in this risk, climbing from seventh to first place. Cameroon and South Africa also experienced a surge in natural catastrophe risks, ranking among the top five risks in these countries.

Regional differences and risk risers and fallers

Climate change (18%) may be a non-mover year-on-year at #7 but is among the top three business risks in countries such as Brazil, Greece, Italy, Turkey, and Mexico. Climate change dropped from fourth to tenth place in Africa and the Middle East compared to the previous year. However, it remains a top-five concern in countries such as Nigeria, Ghana, Mauritius, and Morocco. Physical damage to corporate assets from more frequent and severe extreme weather events are a key threat. The utility, energy and industrial sectors are among the most exposed. In addition, net zero transition risks and liability risks are expected to increase in future as companies invest in new, largely untested low-carbon technologies to transform their business models.

Unsurprisingly, given ongoing conflicts in the Middle East and Ukraine, and tensions between China and the US, Political risks and violence (14%) is up to #8 from #10. The risk moved down to #7 in Nigeria from #2 in 2023. Interestingly, this risk has moved down one place to seventh in Africa and the Middle East, while ranking as one of top five risks in Cameroon and Ivory Coast. 2024 is also a super-election year, where as much as 50% of the world’s population could go to the polls, including in Ghana, Mauritius, Senegal, South Africa, India, Russia, the US, and UK. Dissatisfaction with the potential outcomes, coupled with general economic uncertainty, the high cost of living, and growing disinformation fueled by social media, means societal polarization is expected to increase, triggering more social unrest in many countries.

However, there is some hope among Allianz Risk Barometer respondents that 2024 could see the wild economic ups and down experienced since the Covid-19 shock settle down, resulting in Macroeconomic developments (19%), falling to #5 from #3 and retains #3 position in Nigeria and moved down from #1 to #3 in Africa and the Middle East. It ranks as #1 risk in Cameroon, Ghana, Mauritius, and Nigeria. Yet economic growth outlooks remain subdued – just over 2% globally in 2024, according to Allianz Research.

“But this lackluster growth is a necessary evil: high inflation rates will finally be a thing of the past,” says Ludovic Subran, Chief Economist at Allianz. “This will give central banks some room to maneuver – lower interest rates are likely in the second half of the year. Not a second too late, as stimulus cannot be expected from fiscal policy. A caveat is the considerable number of elections in 2024 and the risk of further upheavals depending on certain outcomes.”

In a global context, the shortage of skilled workforce (12%) is seen as a lower risk than in 2023, dropping from #8 to #10. However, businesses in Central and Eastern Europe, the UK and Australia identify it as a top five business risk. Given there is still record low unemployment in many countries around the globe, companies are looking to fill more jobs than there are people available to fill them. IT or data experts are seen as the most challenging to find, making this issue a critical aspect in the fight against cyber-crime.