In an era defined by digital transformation, data has become the cornerstone of innovation and progress, particularly within Africa’s burgeoning financial landscape. With Sub-Saharan Africa spearheading the global adoption of Mobile Money, boasting over 218 million active accounts according to GSMA’s State of the Industry Report on Mobile Money 2023, the region stands poised to leverage data-driven insights to drive financial inclusion and economic empowerment.

RELATED: Unlocking Prosperity: The 2024 RegTech Africa Conference set to redefine data governance for growth

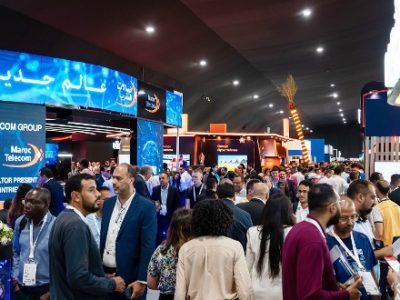

Against this backdrop, the 2024 RegTech Africa Conference is poised to gather thought leaders, policymakers, and industry experts to chart a course towards unlocking Africa’s true prosperity. This flagship event scheduled between 23rd – 24th May, 2024 in Lagos – Nigeria, is set to delve into the pivotal role of data governance in catalyzing Africa’s economic resurgence.

Cyril Okoroigwe, CEO of RegTech Media, underscores the imperative of robust data governance frameworks, remarking, “Africa stands at a transformative juncture, where data has the potential to drive unprecedented socioeconomic advancement. By prioritizing data governance, we can unlock new pathways to innovation, resilience, and inclusive growth across the continent.”

The event will convene an illustrious lineup of speakers from across the globe, each poised to offer invaluable insights into the nexus of data governance, regulatory compliance, and technological innovation. With keynote addresses, panel discussions, and interactive workshops, participants will explore cutting-edge strategies to navigate the complexities of the digital age while fostering trust, transparency, and accountability.

While the promise of data-driven transparency and compliance in Africa’s digital financial ecosystem is immense, several challenges need to be addressed to maximize its impact. This includes issues like data privacy and security concerns, digital literacy, and the need for regulatory collaboration across borders.

“As Africa continues to embrace digital finance, it is imperative that we prioritize data trust and security to safeguard the interests of all stakeholders,” said Okoroigwe. “By enhancing data governance practices, we can empower regulators, financial institutions, and consumers alike to make informed decisions and drive sustainable economic growth.”

By harnessing the power of data, regulators can effectively monitor the activities of financial institutions and detect irregularities, safeguarding against fraudulent schemes and ensuring fair business practices.

From enhancing compliance processes to fostering regulatory collaboration across borders, the conference will explore practical strategies to address the challenges and opportunities presented by data-driven innovation in Africa.

Improving compliance by players in the digital financial ecosystem will go a long way in helping Africa unlock its future. Through data analytics, compliance processes can be automated, reducing the burden on financial institutions while improving accuracy and effectiveness.