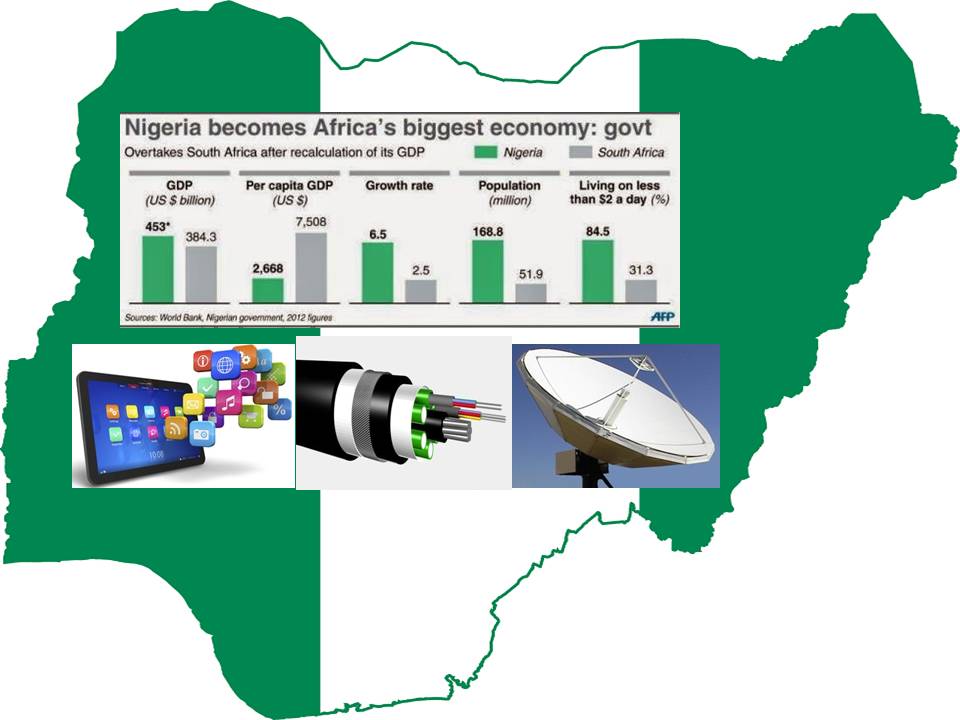

In Nigeria’s newly rebased economy that puts it ahead of other countries in Africa, the telecom sector contributes N6.97 trillion, out of the N80.22 trillion at which the economy is currently sized. Telecom’s share of the country’s GDP is 8.6%.

In Nigeria’s newly rebased economy that puts it ahead of other countries in Africa, the telecom sector contributes N6.97 trillion, out of the N80.22 trillion at which the economy is currently sized. Telecom’s share of the country’s GDP is 8.6%.

What does this mean? It means ‘Nigeria is much more than just an oil enclave.’ That is how the Economist magazine captures it. Far from being a mono-product economy as was previously thought, other sectors have grown exponentially – notably, the communication and entertainment industries. Like the ICT sector, the Nollywood industry was not a major economic factor 24 years ago when Nigeria’s economy was last measured by the Nigerian Bureau of Statistic.

Now, the dynamics that define the pulse of the economy have changed. As Morten Jerven rightly notes in the AfricanArguments, “the size of the Nigerian economy almost doubled. The new total GDP for Nigeria for 2013 was announced as 80 trillion naira, compared to the old estimate for 2013 of 42 trillion Naira. In US dollars that’s an increase of about 250 billion to make 510 billion USD. How much is that? Well in 2012, I guesstimated for African Arguments that the expected increase in Nigeria may mean that at the time there were about 40 Malawi’s unaccounted for inside the Nigerian economy. It turns out there were 58.” Nigeria last rebased its economy in 1990 – 24 years ago.

You could stretch Jerven’s statement to mean a telecom sector that is multiple times the size of what obtains in Malawi and many other African countries in terms of gains and worries. Significant increase in mobile telephone and national broadband penetration has made Information and Communications Technology (ICT) one of the fastest growing sectors of the Nigerian economy. It took less than thirteen years for the sector to achieve this feat. In 2001, before GSM licences were auctioned, the Nigerian telecom sector recorded just about 500,000 telephone lines, but today, the country boasts of over 126 million telephone lines. That is real and encouraging growth. However, there are daunting difficulties that could scare away prospective faint-hearted investors.

ICT is still green, but rebased economy could mean stunted or more explosive growth

While telecoms has significantly expanded the size of Nigeria’s economy, to become the continent’s biggest, this reality holds a mix of promises and aches. The ICT sector as it is today offers both a challenge and an opportunity. Part of the challenge is whether the sector would be able to sustain its current contribution to the GDP and, perhaps, grow over the 8.6% mark. For all its boisterousness, the sector faces multiple challenges that could connive to undermine its growth. These factors include the increasing problem of multiple taxations, rising cases of vandalism and even terrorism against telecom infrastructures – for which the telecom regulator is canvassing legislative interventions to make such infrastructures Strategic National Resource. Others are frequent power outages forcing operators to invest hugely in power infrastructures which in a sense dilute their investment negatively; rising labour cost for the few high skilled personnel; and a sector that is heavily import-depended to sustain its operations.

But the opportunities far outweigh the challenges. Even with operators facing a hostile business environment of high operating costs, and a reducing Average Revenue Per User (ARPU), the Nigerian market still remains one of enormous potential and growth, as analyst Mr. Obi Igbokwe rightly observed.

“The Nigerian market is probably the most liberal and competitive market on the African continent and is likely to remain that way in the next few years. For many experts, including Mr. Lanre Adedeji, the blights in the industry could actually be regarded as a fresh vista for opportunistic investment in newer solutions that will ultimately knock down tariffs and enhance quality of service putting an end to dropped calls, poor voice signal quality inadequate interconnectivity. New investment would mean improved penetration. In terms of phone penetration, only a third of the Nigerian population is served which compares poorly to the more developed South African market which has a higher penetration rate of 76%.

A rebased economy could mean both investments for consolidation and for expansion. The economy is bigger. Much more dynamic and much more sophisticated and increasingly depending more and more on ICT to get going. As Adedeji puts it: “in Nigeria today, daily activities such as shopping, entertainment, banking, manufacturing, office work, education, medical care, governance and even commuting have become increasingly dependent on information and communication networks.”

The industry is untapped in so many areas. A new Pyramid Research Report on Nigeria taking a five-year look at the country’s communications sector believes the fast-paced growth and the huge population, which exceeds 170 million, will continue to make the country one of the most attractive markets in Africa and the Middle East. According to the study, economic growth in emerging markets like Nigeria is expected to double those in developed markets. Telecom service revenue in emerging markets will increase five times faster than in developed markets.

But to make investors leverage on its resized economy, Nigeria has to address the fundamental challenges to real growth. Here is how a market player in Lagos, Mr. Stanley Ukaga, CEO of Auracom practically captures it: “The biggest challenge doing business in this country is the cost of doing business. The high cost of power. Running an office in a high-brow area like Victoria Island means I have to run a generator 9 to 10 hours of the day. The cost of buying diesel is huge. That is the biggest cost in terms of operational cost. The second impediment to any Small and Medium scale Enterprises is finance. We don’t have cheap finance. To a large extent you are forced to finance your business yourself if you are fortunate to have such holdings. If not, if you go to the banks, you will be basically working for the bank. The interest rates fluctuate from bank to bank, but right now they are all operating at about 23 to 25 per cent which is not sustainable. It is usually 5 to 10 per cent in the developed world. With this high interest rate, you cannot compete and it is possible to start looking for ways to cut corners.”

GDP growth can be tied to broadband rollout

Even though only about 5% of broadband capacity from the several submarine cables in Nigeria is being utilised, broadband has contributed greatly to Nigeria’s GDP. As studies have shown, for every 10% increase in broadband penetration in developing countries like Nigeria, there is a commensurate increase of 1.3% in GDP. As of today, Nigeria broadband penetration is about 6%, but the country through the Ministry of Communication Technology and the Nigerian Communications Commission is eyeing a 25-30 % increase by 2017. What this means is that broadband penetration is expected to grow at 5 % each year, and will account for an additional 3.9% of Nigeria’s GDP by 2017.

Mindful of this, government plans to deepen broadband infrastructure rollout across the country. Already, the Nigeria Communication Commission (NCC) has announced plans to issue licence to seven new infrastructure companies, InfraCos before the end of 2014. Secondly, available frequency slots in the 3.5GHz band will be auctioned in 27 states and the FCT. No doubt, each of these licenses would attract revenues close to the $23.25 million that Bitflux, a consortium of three companies paid for snap up the 2.3GHz spectrum licence earlier this year. Analysts believe all these steps will deepen bandwidth penetration and inspire new services or entire new sectors.

International bandwidth in Nigeria has increased about 26 times to more than 9,000 gigabits per second (9 terabits) over the past four years, said Lagos based telecom expert and CEO of Medallion Communications, Mr. Ikechukwu Nnamani. He said “data truly driven by broadband network is the next frontier for telecoms revenues. Currently there is an avid hunger for data services in the country, among individuals, businesses and government.” Latest industry data from the Nigerian telecom regulator has indicated that there were 126 million active telephone subscriptions in the country as at the end of February, 2014. Of this figure, 63.4 million are active mobile internet subscriptions on GSM networks, indicating that there is increasing demand for data-enabled services.

Software paving way for ICT to thrive

If the economy is so big and has a 7.5% annual growth rate, then many industry stakeholders from within the Institute of Software Practitioners of Nigeria (ISPON) believe the local software industry should be actively reflected in this growth particularly for an economy tipping towards diversification. With an estimated value of around $6billion, the local software industry has been largely emasculated by the heavy consumption of lost to imported or foreign software. A worried Dr. Umar Bindir, Director General of National Office for Technology Acquisition and Promotion (NOTAP)said in Lagos recently that revenue from locally made software solutions could surpass that of the oil industry, if only “Nigerian companies can stop importing resources that should be generated locally.” For Bindir, the greatest challenge for the local software industry is acceptability; many people simply can’t come to terms with the possibilities that software is made here in Nigeria.

Also, according to Yele Okeremi, CEO of Lagos based Precise Financial Systems, “software is big business all over the world. The government needs to create the enabling environment for the local software industry to thrive. When you look at government expenditure on Information Technology, it is huge. We do not always have to use our resources to stimulate other economies” adding that “locally developed software solutions are not being adopted because of limited success story.”

In 2012, the global software market was reported to be worth 265.8 billion euros, almost 25% of the global IT market. The software sector has continued to outpace other sectors within it. Between 2007 and 2011, software accounted for 9 per cent of all cross-border Foreign Direct Investment projects. This sector will continue to be a significant source of international investment, driven by renewed market growth, continuous innovation and the need for companies to extend their global reach.

Government is keen to tap into this market, and is at the fore front of campaigning for the patronage of local software, said Mr. Peter jack, the new Director General of the National Information Technology Development Agency (NITDA). The agency is pursuing a policy thrust to promote local software applications ahead of foreign solutions. “We are engaging our local software developers, through a policy that encourages all government ministries, agencies and departments to patronise locally made software. We have established a number of innovation hubs. My team and I have gone on an inspection tour and we are very impressed with what we saw,” said Jack.

Through NITDA’s partnership with the Ministry of Trade and Investment, Jack revealed that there are about 17 million SMEs in existence in Nigeria meaning that the opportunity for IT deployment using local resource is great. “What about one IT person for each of these SMEs? That would translate to about17 million jobs,” said Jack who said government has no choice than to encourage local software companies to tap into the imminent explosion in the development of applications, especially in the area of mobile and online gaming market. According to PricewaterhouseCooper, the global mobile gaming market is worth more than $63 billion in 2012, but is expected to reach nearly $87 billion by 2017.

Mobile money; a relatively new venture

So what will likely happen in the mobile money segment? Another explosion! Some 80 million potential mobile money users market has not even been scratched with huge latent multiplier effects. Despite the fact that more than 70 percent of Nigerians have access to mobile devices and SIM cards, only 35 percent have any knowledge of mobile money services estimated at N1.1 trillion. Mobile money service in Nigeria is yet to catch on with the generality of the populace. Research findings show that only 6 out of 10 Nigerians are aware of the service (59 %), and of that number, only 13% are actually using it.

Two years on, there had been no significant adoption of the services. Only four of the 20 CBN licensed mobile payment operators have interoperability. Data from the Nigerian Interbank Settlement Systems, shows that the volume of mobile payment transactions amongst four inter-operable operators is 646, 000 valued at N3.55bn in 2013.

This ICT Subsector is new, and a lot of lessons need to be learnt. The operators should adopt the right business model as a strategy to benefit from the potential huge N1.1trn mobile money market in the next three years. The key to success in mobile payments in Nigeria will not be based on only the technology or connectivity; it will be on the business model.

Mobile handset: Nigeria is third largest market in the world

Picture this market as the first and second and third in terms of size and you will not be exaggerating. According to the Minister of Finance and Coordinating Minister of the economy, Dr. Ngozi Okonjo-Iweala, Nigeria is the third growing country for demand of mobile phones in the world. This is attributed to its population of over 170 million, and 126 million people wielding mobile phones. Nigeria’s mobile handset market is beginning to rumble as investors start to take cognizance of the huge opportunities in it. It is estimated to be worth N1.26 trillion, going by the average cost of mobile handset puts at N10, 000.

This is huge, and the more reason why new entrants continue to troop into the market expected to experience pulsating growth in the next four years. In the last three years, Tecno, Infinix, Gionee, Solo, Nano and Nerve are all handset manufacturing brands grabbing shares of the Nigerian handset industry from the traditional big brands that include Nokia, Samsung and Sony.

Nigerians are purchasing things online

It is estimated that Nigeria, may almost triple its online purchases in just three years to more than $1billion by 2014. The revolution taking place online, where majority of people purchased goods, paid and delivered to their doorstep, points to the fact that Nigeria has become the newest frontier market for retail sales in the world. Nobody envisaged it five years ago, not even the merchants. But it has come to stay because of the convenience and safety that comes with it. There are many factors responsible for this explosion; they include increased urbanization, rising population, the rise of a working class desirous of convenience and also increased purchasing power.

The nation’s population of over 170 million is growing at 2.7 percent per annum, with a median age of 18.6, while the urban population is estimated at 42 percent, compared with 19 percent in East Africa. Gross domestic product (GDP) is forecast to expand at an average of 6 percent a year for the next five years, according to the International Monetary Fund (IMF) data. There is also a huge remittance flow to Nigeria from Nigerians abroad; this is giving a boost to disposable incomes and retail spending.

With these factors, investment will continue to flow into retailing in Nigeria. Analysts are already predicting that Actis Capital LLP (commonly known as Actis), a private equity firm focused on investments in emerging markets in Africa, China, India, Latin America may make investments of as much as $1.5 billion in African commercial real estate, including Nigeria. Already Shoprite, the South African retail giant sees Nigeria as its growth market as purchasing power plummets in their home country. Retail property plans for Nigeria include the Jabi Lake mall in Abuja, and Ado Bayero Mall in Kano. The most attractive locations for new retail outlets are often the first tier cities of Lagos and Abuja, due to ease of access and superior infrastructure. Second tier cities like Port Harcourt, Kano, Warrri, Owerri and Onitsha are also providing opportunities.

FDIs on the rise

As at the middle of 2012, the telecoms sector had recorded a whopping $25 billion local and Foreign Direct Investment, FDIs, up from the $500, 000 recorded in 2001 with a plan to double the $25 billion in the next years. Broadband is prided as being the potential investment booster for the industry. Thanks to the NCC and the CommTech Ministry, which have continued to leverage on every local and international fora to attract investors into the country.Investors will continue to come to Nigeria, as the regulatory architecture is creating a more level playing field which realistically means ICT would continue to play lead roles in the newly rebased GDP.

In spite of her seeming insecurity and infrastructural challenges, Nigeria still headlines investments leads as the largest economy in Africa and the most preferred investment destination on the continent in terms of returns on investment (RoIs) – and the fourth in the world. What this means is a country’s ICT sector that could offer much and equally demands much from those bold enough to enter the fray as heirs of a new economy.

Knowhow Media International – Additional Report: SEGUN ORUAME, Editor