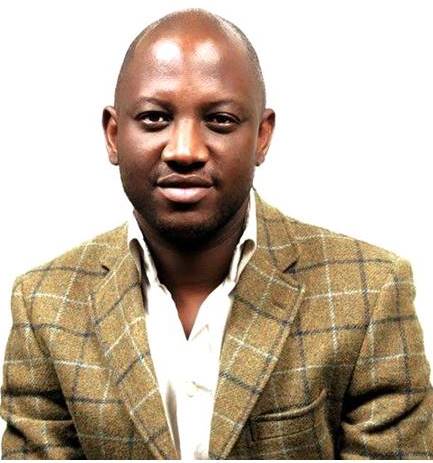

In this interview, Cofounder and Chief Executive Officer of VoguePay, Michael Femi Simeon, discusses with IT Edge News, Anthony Nwosu, on low adoption of online payment in Nigeria and why VoguePay’s online payment system is robust.

VoguePay is a payment firm, what really differentiates you from others?

We are an all-purpose secured payment gateway with a complete suite of modules to support small businesses. It has a unique inbuilt, cross-currency conversion platform that enables businesses to perform inter-currency transactions. For example, a seller in Kenya can initiate a transaction to someone in South Africa with each of them participating in their local currencies. In addition to accepting payment, VoguePay incorporates business intelligence and product management tools that make it easy for SMEs to truly automate their business operations. Merchants can use VoguePay with or without a website. Also opening a VoguePay account is free. VoguePay accelerated online payment adoption in Nigeria by making the cost of integration to be free. Prior to VoguePay, the cost of integrating online payment was over $1,000; an amount that majority of smaller businesses could not afford. The pricing model we launched in 2012 helped to crash the extortionate prices being charged by the big banks at the time (banks were charging $3-5k for payment connectivity and VoguePay charges $0 for the same service).

What is the level of security that is embedded in VoguePay payment platforms?

We deployed four pillars of the security framework. These include anti-money laundering, buyer and seller protection programme, the security of our platform and collaboration with other industry stakeholders. Our platform is highly secured and I see the platform as one of the most secured payment platforms globally. We tell banks about vulnerable transactions, which they were not even aware of. So our system easily detects fraudulent transactions and stops them immediately. We invested so much in security system because we understood the gravity of losses that could occur in any financial institution when security is treated with levity. So we created a system that shows the telemetric behavioral pattern of customers. We currently work with Veridu as our international security partner, which is an internet security system that works across several platforms. We also operate with local partners and we invest heavily in security. So we use both human intelligence and security to enhance our security on a weekly basis.

Are you looking at working with the SMEs?

Our primary targets are small businesses. In addition to the suite of products, we also have various programmes for SMEs and developers. Our partnership/referral programme compensates our partners who are majorly SMEs when they introduce other users to VoguePay platform. This ranges between 10 to 30% commission of our transaction fee.

You recently won an award in Ghana. Do you have your footprints in Ghana?

Yes, we are in Ghana and can be found in other countries of Africa as well as three other continents. We operate from Lagos, Nigeria and London offices. We recently opened an office in Uganda (East Africa). We also have plans to have offices in three other African countries.

Is VoguePay looking at the unbanked, considering the huge population of the un-banked?

One of the major challenges with the un-banked population is illiteracy and high cost of banking. Hence, we work directly with merchants and other regulatory and advocacy groups by championing a reduced cost of online payment access.

Low broadband is a challenge to online payments, are you thinking of offline solutions?

Our product usage is driven primarily by customers’ needs. Our major strength is online web payment; however, we are open to leverage new technologies that enable our merchants to accept payment by offline access. Some possible solutions we have capabilities of include: SMS shortcode system and mPOS.

Nigerians are a bit skeptical about online payments, how are you addressing this?

I quite agree with the school of thought who feel the adoption level is rather slow, and the reason for this is that the government is engaging more of the big players in the financial sector, and neglecting the small players like the market women and men that are petty traders. This set of people need to be carried along with the implementation exercise because SMEs is the bedrock of industrialisation of any nation. The big organisations are not as flexible as SMEs and there is a need to carry along SMEs in the whole exercise of cashless economy. Another reason for the low adoption of online payment is the fear of online security. That is why VoguePay is at the forefront of advocating for security to build market adoption of online payment.