As markets entered 2026, investor attention in semiconductors was shaped by concerns over the durability of AI-driven demand, constrained memory supply, and ongoing policy uncertainty surrounding China, with NVIDIA, Broadcom, Micron, and TSMC consistently influencing sentiment.

RELATED: China orders ByteDance, Alibaba to halt Nvidia AI chip purchases as semiconductor rivalry deepens

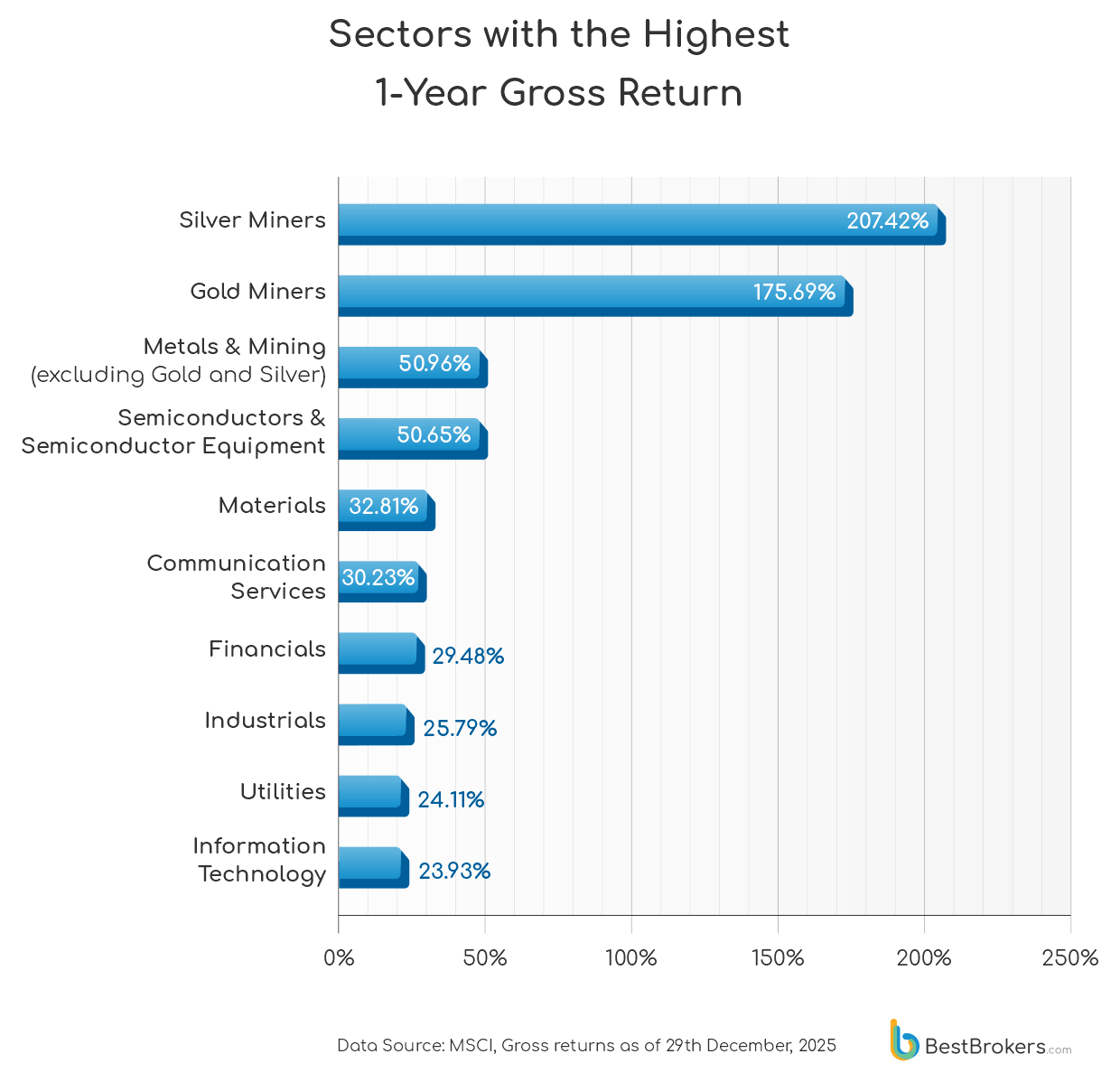

In this context, BestBrokers has released a new report covering the sectors with the highest gross returns in 2025, along with the leading companies driving these gains.

Global performance using the MSCI ACWI Indexes

To find out which sectors and companies led the market in 2025, BestBrokers analysed global performance using the MSCI ACWI Indexes, which cover 20 industries across 49 countries, from Information Technology and Semiconductors to Energy, Health Care, and Consumer Discretionary.

“We examined market capitalisations (full market cap for separate companies and MSCI free-float-adjusted figures for the sectors), average company size, and gross returns across horizons from three months to ten years,” statesBestBrokers.

Data-driven view of the firms shaping market trends

By highlighting the top companies in each sector, the report also provides a clear, data-driven view of the firms shaping market trends and the forces behind sectoral performance. The complete dataset behind the report is available on Google Drive via this link.

The Semiconductor sector posted a 50.65% one-year gross total return, measured by share price appreciation and reinvested dividends, placing it fourth among major sectors. Performance was surpassed only by precious-metals-linked segments, namely Silver Miners, Gold Miners, and Other Metals & Mining, while it remained ahead of Materials and Communication Services. Notably, Information Technology ranked last within the top-ten performers, emphasising the divergence between chipmakers and the broader tech complex.

Here are a few key takeaways from the report

- The Semiconductor sector ranked fourth among major industries in 2025, delivering a 50.65% one-year gross total return. It trailed only the year’s dominant performers in precious metals, where Silver and Gold mining generated exceptional gains of 207.42% and 175.69%, respectively, returns roughly three to four times higher than those of the next-best segment, Other Metals & Mining, which posted a still-strong 50.96%.

- Looking at five-year gross returns, the semiconductor sector ranks second at 23.08%, surpassed only marginally by Gold Mining at 23.45%. It is followed by Energy Producers at 19.78% and Silver Miners at 18.23%. Over a ten-year horizon, semiconductors deliver an average annual gross return of 27.15% – the highest among all 20 sectors analysed, placing emphasis on the industry’s sustained growth profile and long-term structural demand drivers.

- Based on MSCI’s free-float-adjusted data, Semiconductors rank third in average market capitalisation, with an average of $43.19 billion across 249 constituents. Only Information Technology, averaging $80.66 billion across 304 companies, and Communication Services, at $64.82 billion across 123 companies, rank higher. It is also notable that several firms feature across multiple indexes – notably NVIDIA, Broadcom, ASML, and TSMC – reflecting their cross-sector exposure and strategic importance within global equity benchmarks.

- In terms of full market capitalisation in 2025, NVIDIA unsurprisingly led the semiconductor space, standing at approximately $4.56 trillion at year-end. It was followed by TSMC at around $1.67 trillion, making them the only two constituents in the top ten to surpass the $1 trillion threshold. ASML and AMD ranked third and fourth, with market capitalisations of $416.1 billion and $347.8 billion, respectively. In 2025, these firms benefited from sustained AI-driven demand, expanding data-centre investment, and their entrenched positions within critical global semiconductor supply chains.

2026 will reward semiconductor firms with defensible tech leadership

‘The semiconductor space enters 2026 at a critical inflection point, where long-term structural demand remains intact but short-term performance is likely to become more selective. After a year in which returns were driven by scale, pricing power, and AI-related capital expenditure, investor focus is shifting toward earnings durability, capacity discipline, and geopolitical resilience. Companies embedded deepest in AI infrastructure, advanced-node manufacturing, and mission-critical equipment are best positioned to sustain momentum, while segments exposed to cyclical end markets or slower inventory normalisation may face compression.

At the same time, policy uncertainty around China and rising capital intensity across the supply chain suggest higher dispersion of outcomes, reinforcing a move away from broad-based rallies toward stock-specific performance. Overall, 2026 is likely to reward semiconductor firms with defensible technological leadership, strong balance sheets, and clear visibility on demand beyond the current AI investment cycle.’

– comments Alan Goldberg, analyst and author at BestBrokers.

More detailed information can be found in the full report, while the dataset we’ve compiled is available on Google Drive via this link. Feel free to use any data or graphics by providing a proper attribution link to the original report.