The headlines in August 2025 have been dominated by speculation over which companies will drive the next wave of market cap and valuation growth. The speculations vary from NVIDIA’s projections to reach $9T by the end of the decade to forecasts about how Uber might become a trillion-dollar company. Then there is Oracle and Palantir, which are moving steadily toward this milestone.

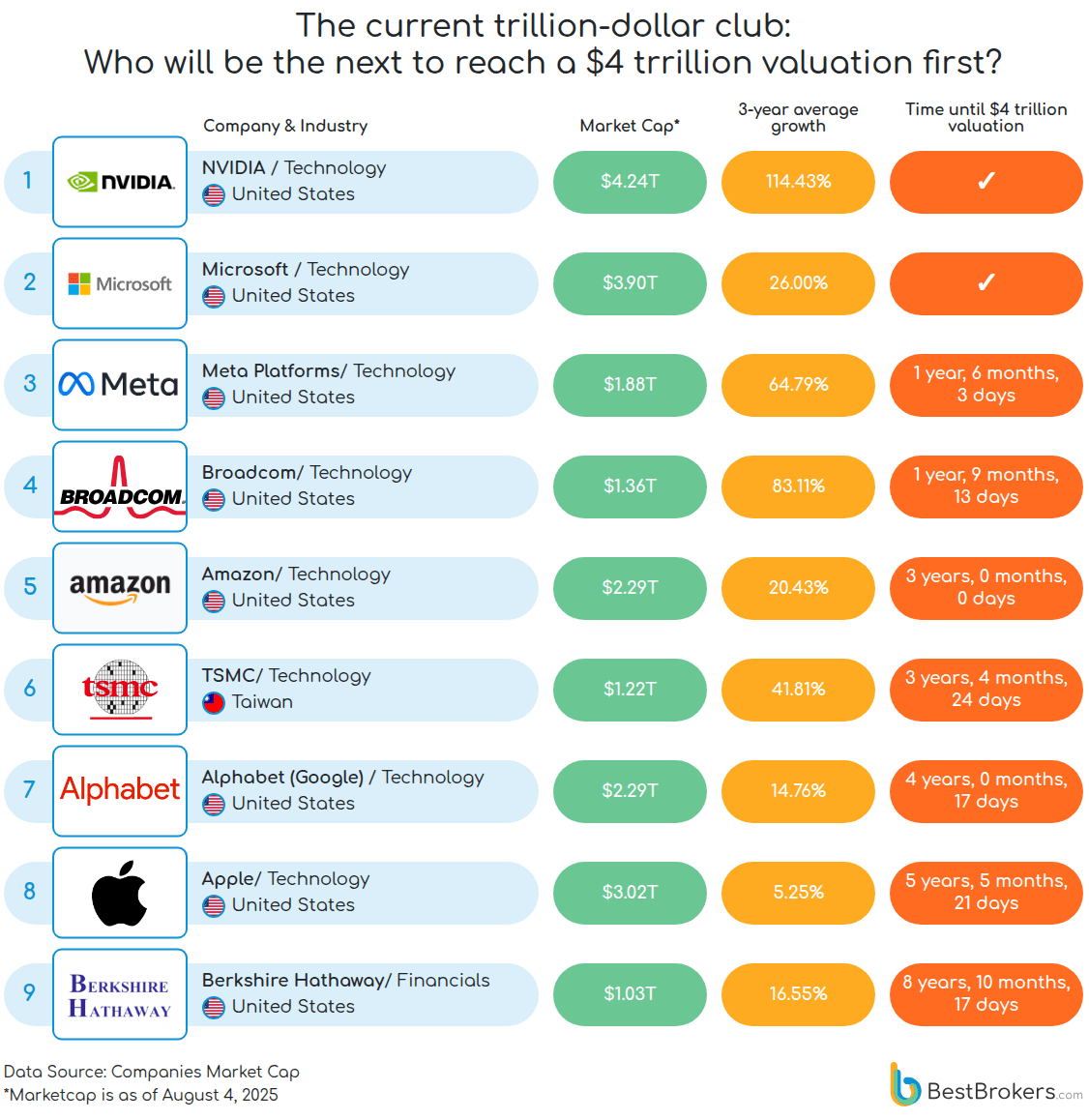

In light of this, a new piece of research by BestBrokers is revealing which of the current trillion-dollar companies will most likely be the next one to reach a $4 trillion market capitalisation.

In order to track the progress of the current trillion-dollar club, to identify which companies are poised to break into it, and to forecast the frontrunners in the race towards $4 trillion, the team at BestBrokers analysed the market capitalisations of the 20 most valuable global companies as of August 4th, 2025, sourced from CompaniesMarketCap.com. U

sing their historical average growth rates since 2022, the team projected future valuations and estimated the time needed for each to hit the $1 trillion or $4 trillion milestones. The complete dataset can be accessed via Google Drive at the provided link.

Recent data indicates that the absolute market cap of the largest companies appears to be less significant than the pace at which their market caps are growing. Among current members of the trillion-dollar club, Meta and Broadcom are projected to be the fastest to reach the $4 trillion threshold after NVIDIA and Microsoft, despite their market caps remaining below those of Amazon and Apple. At the same time, Netflix has yet to cross the $1 trillion milestone, but if its current growth trajectory continues, it is on course to reach $4.2 trillion by 2028.

Here are some key takeaways from the report

- Meta Platforms is on track to become the next company to cross the $4 trillion mark – with a current market cap at $1.88 trillion, the social media and AI giant has averaged 64.79% growth over the past three years and is projected to surpass $4 trillion by February 2027, reaching as high as $8.34 trillion by July 2028.

- Just a few months after Meta, Broadcom is projected to reach $4 trillion by May 2027, recording the second-highest three-year growth among the 20 companies on our list at 83.12% after NVIDIA at 114.43%. This trajectory not only explains why NVIDIA was the first to cross $4 trillion but also reinforces that growth remains the most telling indicator of which companies are poised to hit these market cap milestones.

- Netflix ranks as the third-fastest-growing company, with a three-year growth rate of 71.37%. It is on track to reach $1.4 trillion by 2027 and nearly triple its current valuation to $2.48 trillion by 2028. Remarkably, this surge comes while Netflix has yet to cross the $1 trillion milestone, with its market cap currently standing at $514.14 billion, highlighting just how quickly the company is climbing the ranks of the world’s most valuable firms.

- With three-year growth rates of 52.87% and 41.81%, Oracle and TSMC are steadily advancing toward the $4 trillion market cap milestone. TSMC is projected to reach it by the end of 2028, while Oracle is expected to follow at the end of 2029. Both are likely to move more slowly than Amazon, whose current market cap of $2.4 trillion gives it a significant head start in the race.

Projections reflect a shift in how market dominance is evaluated

‘The dynamics revealed by these projections reflect a shift in how market dominance is evaluated: growth pace is increasingly as critical as current size. Meta and Broadcom, already members of the trillion-dollar club, are advancing rapidly toward $4 trillion, while Netflix shows that smaller firms can climb the rankings quickly, if growth remains strong. This suggests that future market cap leadership may favour firms combining scale with high growth and highlights potential volatility among top-tier companies, as Amazon and Apple could see their relative positions challenged. Looking ahead, a handful of fast-growing technology and AI-driven companies are likely to consolidate value, with Netflix exemplifying how rapid expansion can disrupt expectations and close gaps with established giants.’

– comments Paul Hoffman from BestBrokers.com

For this analysis, the BestBrokers team used data from CompaniesMarketCap on the 20 most valuable publicly traded companies as of 4 August 2025. By measuring market cap growth from 2022 to 2025, they ranked firms on the time needed to reach $4 trillion if already above $1 trillion, or to hit $1 trillion if below that threshold.

More detailed insights on company market capitalisations and projections can be found in the full report. The complete dataset is available on Google Drive via the provided link.