As financial institutions and bookkeeping practices increasingly see AI as the key driver of innovation in the sector,1 the world’s leading finance hubs rely on steady progress in digital regulation, education, and workforce development to maintain their edge.

With this in mind, Amazon accountants Archimedia Accounts set out to identify which countries are best prepared for AI integration in their finance industries. Their experts analysed critical data to measure AI readiness in finance, including job market demand, higher education, investment, and legislation.

Key findings:

- The United Kingdom has the largest number of finance jobs requiring AI skills per 100,000 people at 2.18 vacancies in August 2025.

- The United States’ finance industry is the most prepared for AI integration.

- China prioritises investment in AI over regulatory frameworks.

- Sweden shows high digital readiness, but disproportionate investment and market demand.

AI in finance: Which countries are ahead?

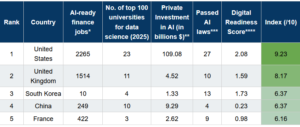

The U.S. dominates across the board

The U.S. leads across every key metric, including the highest number of finance jobs requiring AI skills (2,265 as of August 2025), the most top-ranked universities for data science and AI (23), and the largest private AI investment, totalling $109.08 billion in 2024. This figure accounts for over 85% of total investment among the top five countries, underscoring the U.S.’s investment-driven approach to AI integration in business. The country also leads in regulation, having passed 27 AI-related laws between 2016 and 2024, more than any other nation.

The UK is a strong all-rounder

In second place is the UK, positioning itself as a well-rounded leader in AI readiness through consistent progress in regulation, education, and workforce development. The UK currently has 1,514 finance job openings requiring AI skills, the highest per capita globally at 2.18 jobs per 100,000 people. Its academic strength is notable, with 11 universities ranked in the global top 100 for data science. While private AI investment stood at a moderate $4.52 billion in 2024, the UK has enacted 10 AI-related laws, reflecting a proactive approach to AI ethics, safety, and governance, a key driver of its strong digital readiness score and overall index ranking.

South Korea, China, and France complete the top five

South Korea shows a mixed profile: while demand for AI-skilled finance professionals remains low, the country stands out for its high digital readiness score (1.73) and a proactive legislative approach, having passed 13 AI-related laws. In contrast, China’s AI strategy is investment-led, with $9.29 billion poured into the sector in 2024; however, it is accompanied by relatively limited regulation (four laws) and low job demand for AI-skilled finance roles. France demonstrates moderate AI readiness, supported by $2.62 billion in investment, 9 AI-related laws, and 422 finance job openings requiring AI expertise.

Closing the gap: Finance hubs with growing AI-readiness

*In August 2025. **In 2024. ***Between 2016-2024. ****Cisco’s index can be found here.

Several countries are emerging as notable contenders in the race for AI readiness in finance, each showing strengths that signal future potential.

- Canada combines a strong digital foundation and significant private AI investment ($2.89 billion), though its progress is tempered by limited job market demand and a lack of AI-specific legislation. \

- Germany stands out with one of the highest numbers of AI-skilled finance jobs (933) and moderate legislative and investment efforts, despite a relatively small academic footprint.

- Italy, while lower in digital readiness, is proactive on the policy front with 10 AI laws and a respectable 478 finance jobs requiring AI expertise.

- Sweden leads in digital infrastructure and boasts high per-capita investment ($4.34 billion), yet its AI job market remains minimal.

- Meanwhile, the Netherlands offers a balanced profile, with solid readiness and academic strength, though it too shows limited traction in workforce demand and regulatory activity.

Together, these countries form the next wave of AI-prepared economies positioned to rise but not yet leading the charge.

How will AI impact finance and accounting?

The experts at Amazon Accountants Archimedia Accounts explain:

“AI is set to transform finance from a reactive to a predictive discipline by automating routine tasks, enhancing fraud detection, and enabling real-time decision-making through data analysis. At Archimedia Accounts, we see AI not as a replacement but as a powerful tool that will elevate the role of finance professionals from number crunchers to strategic advisors. Countries leading in AI integration today will shape the global financial standards of tomorrow.”