With AI companies constantly making headlines with their breakthroughs, sensational claims, or just as thrilling failures, the latest report by BestBrokers explores the world of venture capital and the most significant investments in AI and machine learning in 2025.

Artificial intelligence, large language models, and data centres are among the most promising and exciting industries nowadays, with the global AI market predicted to reach $4.8 trillion by 2033.

RELATED: $8.7T pours into world’s 10 largest AI companies’ market cap since ChatGPT debut

To identify the major AI investment deals in 2025 and track the shifting dynamics of venture capital in the sector, the team at BestBrokers collected investment and fund data from Pitchbook, CB Insights, and several other sources and analysed the latest financial disclosures from leading venture capital firms. All findings and datasets referenced in this report are available in full via Google Drive via this link.

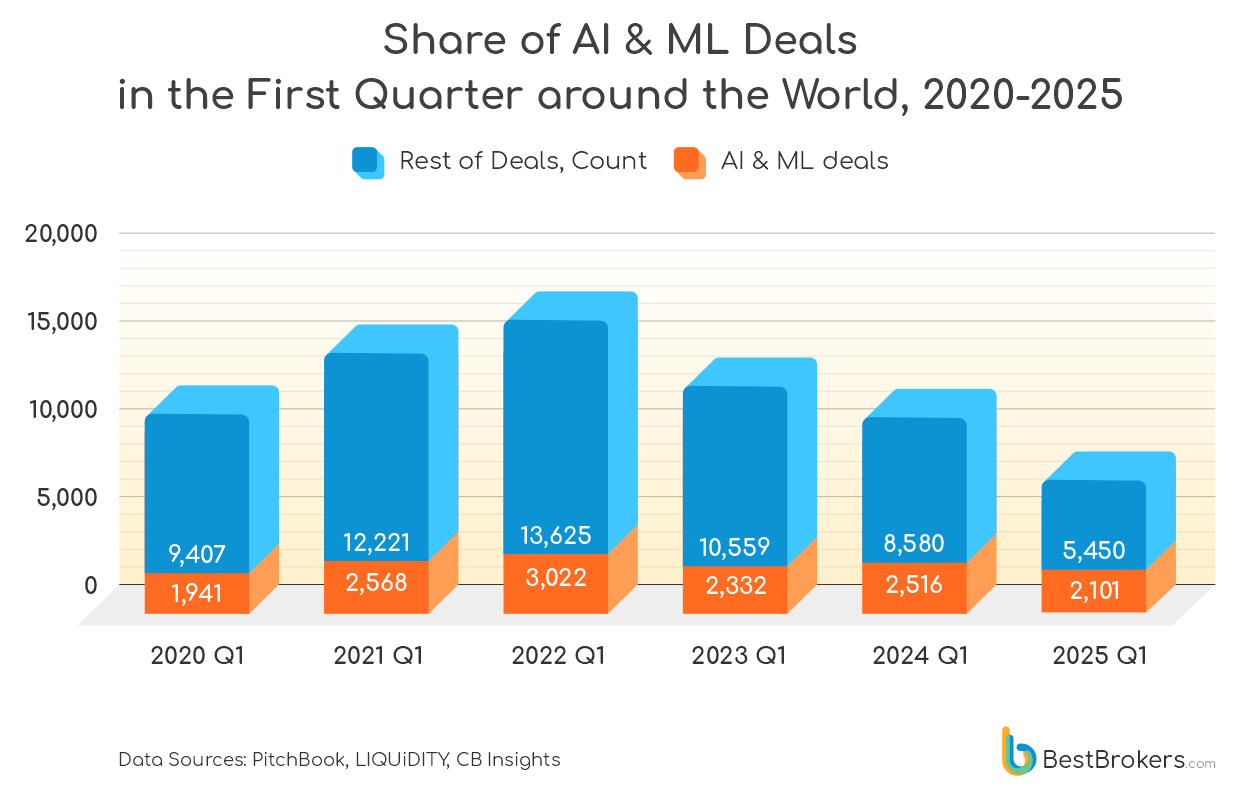

Figures show that funding for artificial intelligence and machine learning startups has been steadily rising since 2015. While Q1 2025 recorded the lowest number of VC deals since 2020, it also marked a high point in AI investment: more than 57% of global venture capital funding during the quarter went to AI and machine learning startups.

Key takeaways from our report:

- In Q1 2025, venture capital firms invested a total of $126.3 billion, with $73.1 billion directed toward private AI and machine learning startups (57.9%), marking the largest quarterly investment in the sector’s history.

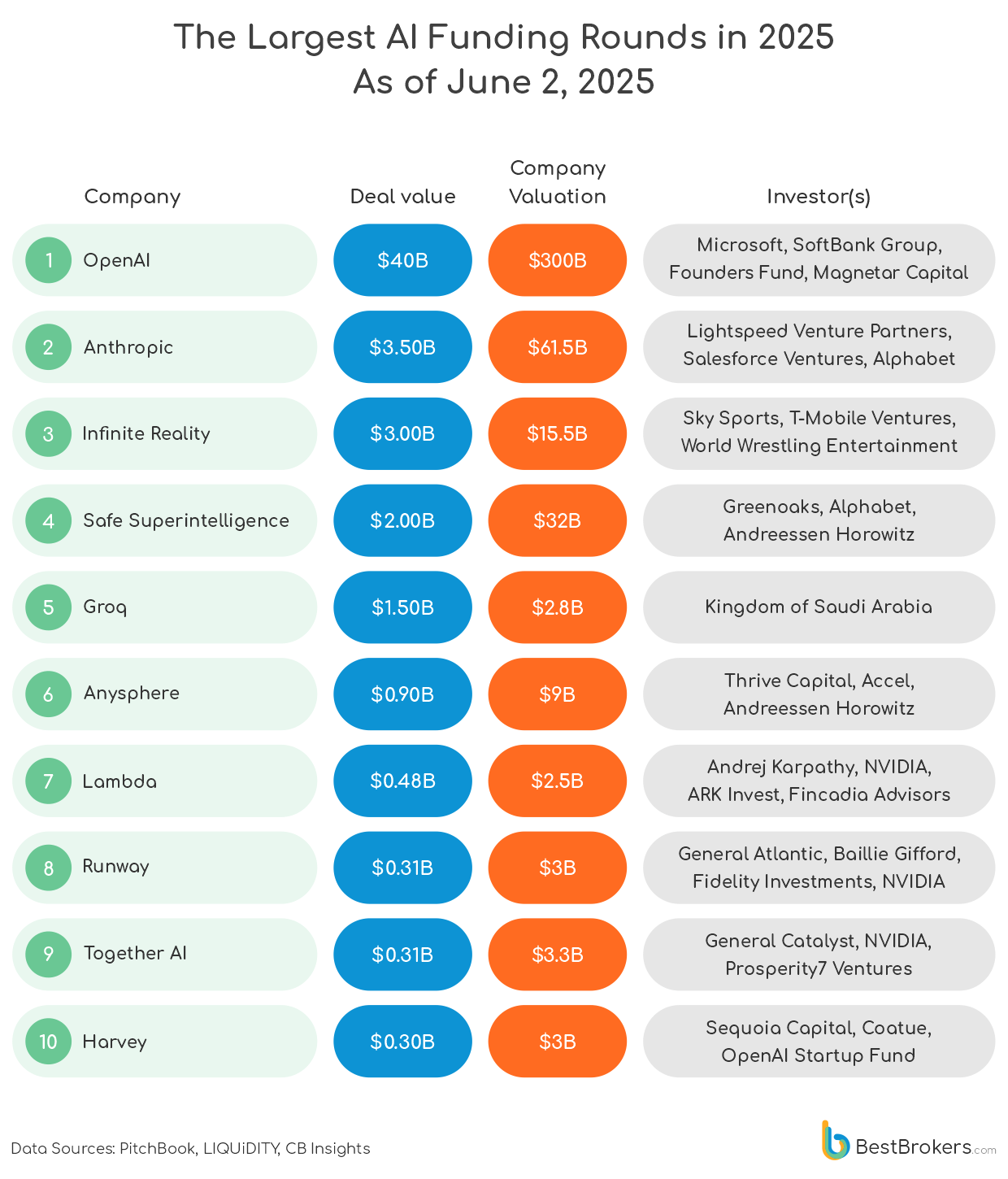

- The largest AI investment of the quarter came from SoftBank’s $40 billion deal with OpenAI, which propelled the company’s valuation past $300 billion and set a new global record for the largest private tech investment to date.

- The total number of VC deals in early 2025 fell to just 7,551, the lowest in over a decade, reflecting growing caution among firms toward startups that lack a clear path to monetisation.

- In Q1 2025, VC firms made 2,101 investments in AI and ML startups, accounting for approximately 27.8% of all recorded deals, the lowest number of AI-focused investments since Q4 2020.

- North America leads in both AI venture deal count and investment value. In Q1 2025, firms in the region were responsible for 1,056 of the 2,101 AI deals recorded. More notably, North American VC funds contributed $65.3 billion-an impressive 89.3% of the $73.1 billion invested globally in AI and ML startups since the start of the year.

In 2015, AI deals represented just 8.6% of all VC-backed investments. By Q1 2025, that share had climbed to 27.8%. Even more striking is the leap in funding value: AI startups attracted 57% of global venture capital investment this quarter, underscoring the growing confidence investors have in the future of artificial intelligence.

AI has undergone exponential growth in recent years, becoming a foundational element across modern tech sectors. Substantial backing from major investors, including SoftBank’s Vision Fund, Andreessen Horowitz, and Tiger Global Management, continues to fuel innovation and attract a new wave of entrepreneurs eager to tap into the potential of this transformative technology.

More information on VC investments, major AI deals, and the complete methodology can be found in the full report. The raw dataset is also available on Google Drive via the following link. Feel free to use any data or graphics for publication by providing a proper link attribution to the original report.