By Shabir Ahmed, Industry Advisor: Energy & Resources at SAP Africa

A growing wealth of evidence shows that sustainability has become a mainstream business and societal issue. Leading companies are embracing sustainability not only to reduce harmful practices but also to accelerate business transformation while protecting and creating value.

Bloomberg reports that the value of total ESG assets may reach $50-trillion by 2025, accounting for a third of total assets under management globally. This is nearly double the $22.8-trillion in ESG assets under management in 2016.

RELATED: SAP, PwC partnership driving digital transformation and cloud success in West Africa

Effective sustainability-led business transformation creates long-term value for organisations as well as the communities and environment in which they operate. And when sustainability is embraced, it drives innovation across the business, leading to benefits for employees, customers, communities and investors.

However, there isn’t really a template for sustainability that can be repeated across businesses and industries. Each business needs to find tailored approaches to sustainability that take into account its industry, customers, business model and geographical market.

And nowhere is this more apparent than in the energy sector.

Energy market shows complexity of sustainability

The latest data from the International Energy Agency shows the global consumer energy bill topped $10-trillion for the first time in 2022.

Amid growing demand for reliable energy from a global population that has swelled past the eight billion mark and severe energy constraints resulting from the conflict in Ukraine, many countries have had to rethink their energy mix.

At or near the top of priority lists is the transition to cleaner, more sustainable and less environmentally-damaging forms of power generation, mostly from renewable energy sources such as wind and solar.

Calls for a ‘just transition’ have grown over the past few years as devastating storms, widespread flooding and extreme temperatures bring home the distinct dangers of a warming climate.

The World Economic Forum reports that global energy investment reached $2.4-trillion in 2022, of which a record $1.4-trillion is investments into clean energy. However, most of that investment stemmed from more developed Western economies.

In emerging markets, investments into clean energy are more complex, partly due to the availability of natural resources, where fossil fuels such as coal are easy to mine and readily available.

To achieve sustainability goals in emerging markets while still driving growth and economic progress, organisations need to develop smart, tailored strategies. But it can be challenging to understand where to start.

Sustainability requires tailored strategies in emerging markets

Developed countries have already leveraged carbon-intensive forms of energy to build their industries and boost their economic growth.

A transition to cleaner energy is arguably much easier in developed economies than their emerging market peers, where many of the developmental gains enjoyed by Western economies are still to be realised.

Much of Africa is still in a process of industrialisation and urbanisation, a transition that developed economies have long since completed. To build industries, support economic development and accommodate a rapidly growing population, African countries need access to affordable, readily available forms of energy.

This means that fossil fuels will likely remain a core part of the energy mix across much of Africa, especially in industries such as manufacturing and mining, where wind and solar power simply can’t provide the baseload energy needed for production.

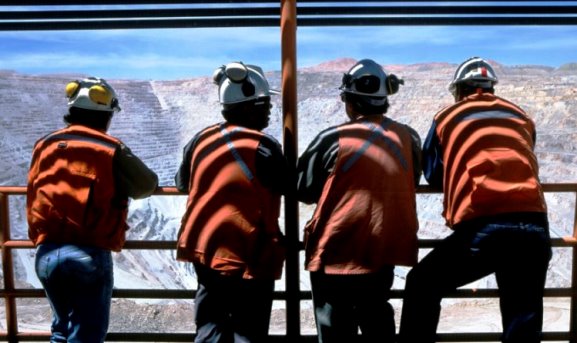

Take mining as an example. The mining industry has traditionally been among the leading consumers of energy. As energy capacity becomes increasingly constrained, especially in countries like South Africa, mining operations have had to reduce their reliance on the national grid and build their own stable power supply.

This has led to huge investment into solar energy as a means of keeping the lights on. The power generated through solar helps power mining fleets and support the running of the entire operation. Some mining companies have even invested in hydrogen-powered vehicles as a means of reducing reliance on the grid.

However, solar power cannot provide the power needed for energy intensive processes such as smelting. For these processes, mines and manufacturers still need to rely on less sustainable forms of power.

Plotting a viable course for sustainability

Understanding the need to balance sustainability with business viability, how can African organisations start their journey toward sustainability in a way that still drives successful business outcomes?

Firstly, sustainability does not mean sacrificing profits. In fact, companies that successfully integrate sustainability into their strategies can potentially unlock a broad range of benefits, including increased revenue, reduced material expenses, reduced utility and fuel expenses, greater employee productivity and talent retention, and reduced hiring expenses.

Secondly, companies that can effectively manage their ESG (Environmental, Societal and Governance) risks can see a boost to their reputation, improved management of tax costs, and greater scope for investment to unlock long-term value. Incorporating sustainability into the core business strategy therefore holds the potential to deliver immense benefits, and should be a top priority for business leaders.

Third, when developing a business case for sustainability, organisations need to take a three- to five-year approach, which provides enough time to allow for new initiatives to gain the traction needed to yield results. The business case should be developed in alignment with core elements of the company income statement to ensure each sustainability benefit is directly tied to a measurable business outcome.

Funding for sustainability initiatives should come from existing line items in operational budgets, similar to how aspects such as marketing, education, and communication are budgeted for. Savings achieved through reduced material and utility expenses or reduced hiring expenses can be allocated to fund further sustainability efforts, unlocking additional cost savings.

Finally, organisations should understand that remaining trapped in the inertia created by unsustainable business models will make it difficult to succeed as they lose loyalty, talent, customers and market share to their more sustainable peers. By proactively making sustainability a core part of their business strategy, African organisations can discover new sources of competitive advantage for all stakeholders.