Investors Brace for Nvidia’s Critical AI-Era Earnings Moment

Nvidia is heading into what analysts describe as its toughest earnings test yet, as the global AI boom heightens expectations and scrutiny. US equity futures advanced ahead of the chipmaker’s earnings release this week, reflecting strong confidence from investors — but also signalling rising vulnerability.

RELATED: deVere CEO warns Nvidia’s $5 trillion ai boom is running ahead of profit reality

According to Nigel Green, CEO of global financial advisory firm deVere Group, the upcoming results will demand “sharper attention” as markets assess whether Nvidia’s explosive AI-driven growth is truly sustainable.

Sky-High Expectations: Revenue Forecasts Near 55% Growth

Analysts expect Nvidia to deliver another blockbuster quarter, with consensus pointing to:

- ~55% year-on-year revenue growth

- A parallel surge in net earnings

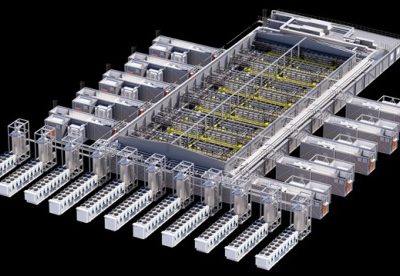

- Strong demand driven by the Blackwell GPU platform

- Continued massive spending by hyperscalers and sovereign AI projects

This optimism, however, is precisely why caution is building.

“The market has priced in extraordinary strength,” Green warns. “The reaction depends on whether Nvidia proves the AI boom is expanding profitability, not just scale.”

Margins, Export Controls and Blackwell Adoption in Focus

Investors are shifting toward companies demonstrating:

- disciplined spending

- clear strategy

- credible monetization

Nvidia’s numbers must reflect all three.

Key pressure points include:

1. Margin Performance

Despite exceptional profitability, every detail will be dissected — from data-center revenue mix to early Blackwell adoption rates.

2. Hyperscaler Demand

The pace at which cloud giants place new orders will signal how quickly AI infrastructure spending is evolving.

3. US Export Controls

Washington’s tightening restrictions on advanced chip sales to China remain a major overhang, with investors eager for clarity on demand lost to regulatory limits.

4. White House Policy Environment

The market will watch for Nvidia’s long-term positioning under President Donald Trump, particularly regarding:

- AI supply-chain security

- Domestic semiconductor leadership

- Sovereign computing strategy

Guidance May Matter More Than the Results

Beyond the numbers, Nvidia’s commentary on forward demand is expected to heavily influence market sentiment, especially around:

- Sovereign AI contracts

- Global inference growth

- Customer digestion of Hopper GPUs ahead of full Blackwell migration

Green notes:

“Forecasts for another beat are widespread, but valuation rests on belief in durability, not just velocity.”

AI Sector Outlook Hinges on Nvidia’s Performance

Nvidia’s earnings are now a bellwether for the entire AI investment cycle. Recent Big Tech results showed a widening gap between companies investing wisely and those overspending.

A strong quarter from Nvidia could reinforce confidence across the sector. But even a slight miss could trigger a sharp sentiment shift after one of the strongest multi-year stock surges in market history.

Green concludes:

“Nvidia’s results are a test of global conviction in AI. The opportunities remain enormous — but the scrutiny is rising just as quickly.”