Despite subscriber loss and declining data consumption, teledensity and active telephone lines show resilience in Q1 2025.

Tariff Hike Triggers One Million Internet User Drop in February

Nigeria’s telecommunications industry experienced a significant setback in February 2025, losing nearly one million internet subscribers following a 50% increase in voice, data, and SMS tariffs implemented in January. According to the Nigerian Communications Commission (NCC), the number of internet users declined from 142.16 million to 141.25 million during the month.

RELATED: ATCON and ATICEN applaud NCC’s 50% telecom tariff adjustment, highlight industry sustainability challenges

Although March saw a modest rebound to 142.05 million users, the report noted that data consumption habits remained cautious, influenced by the new tariff structure.

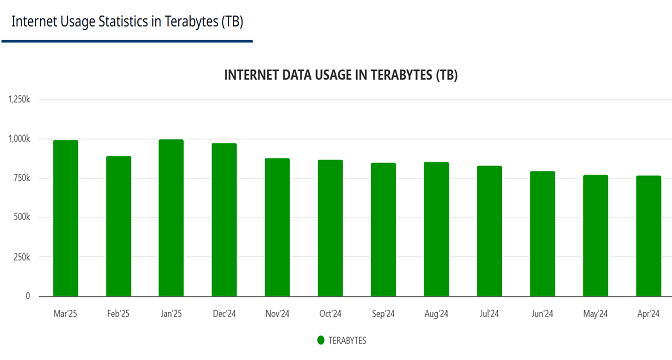

Monthly Data Usage Declines by 12%

The NCC’s report showed that monthly data usage dropped sharply in February to 893.06 petabytes, down from January’s peak of over one exabyte. In March, data consumption increased by 11.5% to 995.88 petabytes, indicating a gradual recovery.

However, usage remained below pre-hike levels, suggesting that consumers are still adjusting to higher internet costs.

Teledensity and Voice Subscriptions on the Rise

Despite reduced data usage, Nigeria’s telecom sector saw positive momentum in voice subscriptions. Between January and March 2025, operators added 3.39 million active lines, bringing the total from 169.32 million to 172.71 million.

This increase pushed national teledensity up from 78.10% to 79.67%, signaling resilience in voice services despite challenges in the data segment.

MTN Leads Market in Data and Voice Subscribers

Among the Mobile Network Operators (MNOs), MTN Nigeria maintained its market dominance with:

- 75.62 million internet subscribers

- 90.5 million active telephone lines

- 52.48% market share in voice services

Airtel Nigeria followed with 48.8 million internet users and 58.3 million active lines (33.78%), while Globacom held 15.37 million data subscribers and 20.7 million active lines (12%). 9mobile trailed with 1.75 million internet users and 2.9 million voice subscribers (1.72%).

Porting Trends: 9mobile Faces Major Subscriber Exodus

The NCC report also highlighted mobile number porting activity, showing that 9mobile experienced the highest customer losses with 5,809 subscribers porting out in February and March. In contrast:

- MTN lost 647 users

- Airtel saw 695 port-outs

- Globacom had 771

In terms of incoming porting, MTN emerged as the biggest gainer with 4,855 new subscribers from rival networks. Airtel gained 2,084, and Globacom added 1,007. 9mobile, however, recorded only three incoming ports, signaling continued customer attrition.

In total, 7,922 mobile subscribers switched networks over the two-month period.

Industry Outlook: Navigating Economic Pressures and User Behavior Shifts

The latest NCC statistics underscore the challenges facing Nigeria’s telecom sector, including economic volatility, consumer sensitivity to price changes, and intensifying competition among operators. As data consumption declines and subscriber mobility increases, telecom operators will need to adapt with improved service quality, affordable packages, and innovative digital offerings to retain users.