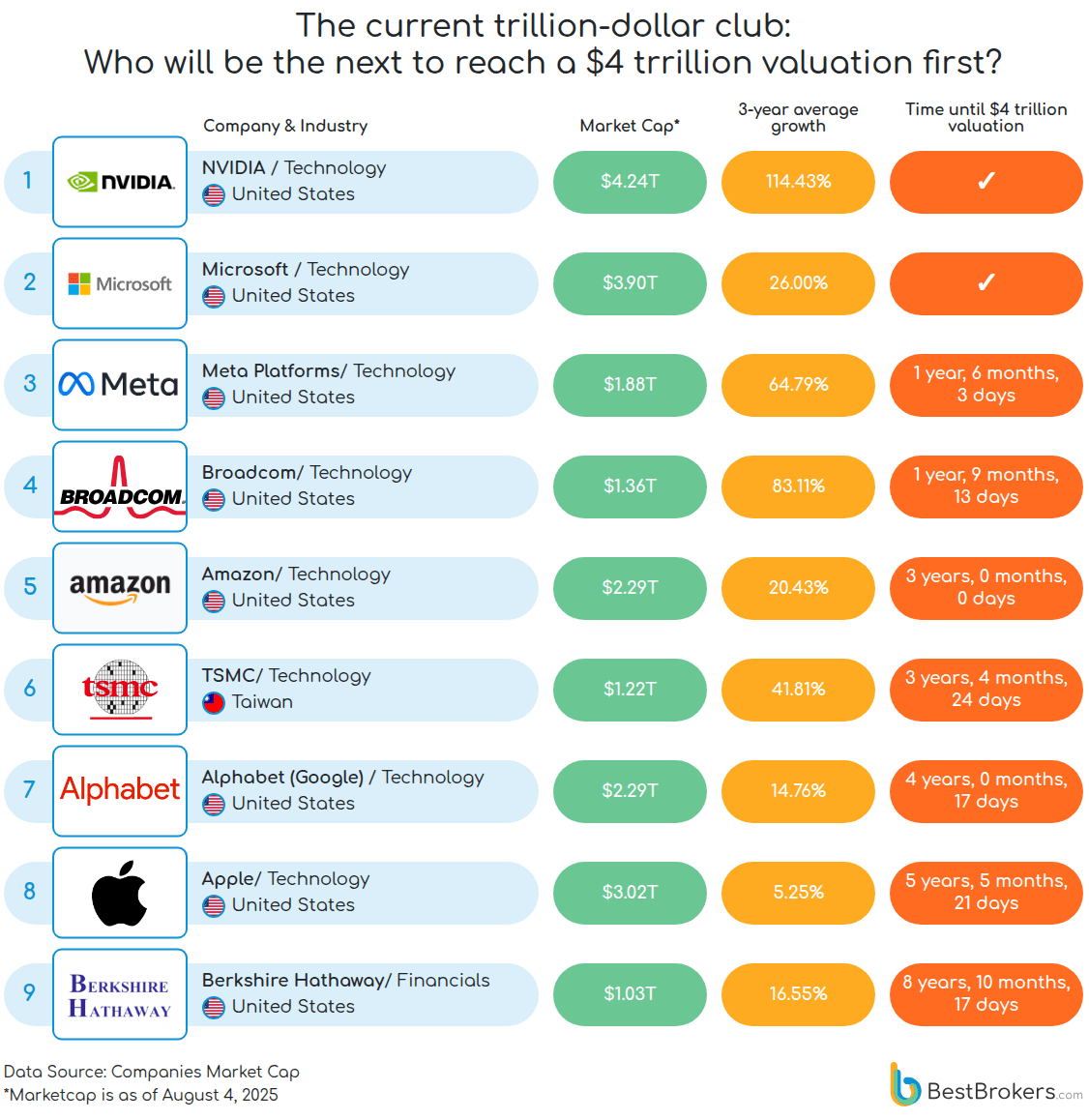

Microsoft achieved $4 trillion in market value on July 31, becoming the second publicly traded company after Nvidia to surpass that milestone. BestBrokers has unveiled a new piece of research revealing which of the current trillion-dollar companies will most likely be the next one to reach a $4 trillion market capitalisation.

RELATED: Report reveals VC investments in AI hit record $73.1B in Q1 2025

To find out which companies are on track to reach a $4 trillion market valuation and which are poised to join the $1 trillion club soon, BestBrokers analysed the market capitalisations of the 20 most valuable global companies as of August 4th, 2025, sourced from CompaniesMarketCap.com.

Using their historical average growth rates since 2022, the team projected future valuations and estimated the time needed for each to hit the $1 trillion or $4 trillion milestones. The complete dataset can be accessed via Google Drive at the provided link.

META is well placed to join Nvidia and Microsoft

The analysis indicates that Meta Platforms (META) is well placed to join Nvidia and Microsoft in crossing the $4 trillion market cap threshold, potentially reaching this milestone by early 2027 if current growth trends continue.

Close behind is Broadcom, one of the newest members of the trillion-dollar club, projected to hit $4 trillion by May 17, 2027, fueled by its critical position in AI infrastructure and rising investor interest in core technology providers.

Key takeaways from the report

- As of August 2025, just ten publicly listed companies worldwide have achieved market capitalisations exceeding $1 trillion. With the exception of oil giant Saudi Aramco and Taiwan’s TSMC, the entire group comprises U.S.-based technology firms. Two of these companies, NVIDIA and Microsoft, have recently crossed the $4 trillion threshold, marking a new era in corporate valuation driven by the accelerating demand for artificial intelligence and cloud technologies.

- Meta Platforms appears best positioned to become the next company to reach a $4 trillion market valuation. With a current market capitalisation of $1.88 trillion and an impressive three-year average growth rate of 64.79%, the social media and AI-driven technology giant is projected to cross the $4 trillion mark by early February 2027.

- A surprising contender for the $4 trillion milestone is Broadcom, which is forecast to reach that valuation by May 2027. If the semiconductor firm maintains its current momentum, marked by a remarkable three-year average annual growth rate of 83.12%, its market capitalisation could soar to as much as $8 trillion by 2028.

Eyes on Amazon

- Amazon and TSMC are poised to reach $4 trillion in market value by late 2028, with Amazon forecast to hit the mark by 3 August and TSMC by 26 December, driven by strong performance in cloud and chip sectors respectively. Google (Alphabet) and Apple, despite higher current valuations, are expected to follow at a slower pace, reaching $4 trillion by August 2029 and January 2031, reflecting more modest growth trajectories.

- Berkshire Hathaway, which joined the $1 trillion club in August 2024, is expected to be the last to reach a $4 trillion valuation, projected to do so by June 2034. If its three-year average growth rate of 16.55% holds, the company’s market cap could rise to $1.63 trillion by 2028, around 59% higher than its current value of $1.03 trillion.

The $4 Trillion Club: Who Next?

‘NVIDIA and Microsoft’s recent breakthrough past the $4 trillion valuation milestone underscores the central role of artificial intelligence and cloud computing in shaping today’s market leaders. Meta Platforms is on a clear path to join this elite group by early 2027, driven by its sustained high growth rate and strategic focus on AI and immersive technologies” – comments Paul Hoffman from BestBrokers.

He added:

Meanwhile, Broadcom’s rapid ascent, backed by an extraordinary growth rate exceeding 80%, highlights the critical importance of semiconductor innovation as the backbone of AI infrastructure. The race to $4 trillion is now concentrated among companies that not only dominate software and services but also command the essential hardware platforms powering the AI revolution, signalling a new era of specialised technological leadership.’

For this analysis, BestBrokers team used data from CompaniesMarketCap on the 20 most valuable publicly traded companies as of 4 August 2025. By measuring market cap growth from 2022 to 2025, they ranked firms on the time needed to reach $4 trillion if already above $1 trillion, or to hit $1 trillion if below that threshold.

More detailed insights on company market capitalisations and projections can be found in the full report. The complete dataset is available on Google Drive via the provided link. Feel free to use any data or graphics with proper attribution to the original work.