Africa’s overall identity fraud rate fell slightly to 3.42% in Q1 of 2025, down from 3.50% in Q1 2024, according to new data from global verification platform Sumsub*.

RELATED: Americans lost an unprecedented $3.56B to online fraud in H1 2022

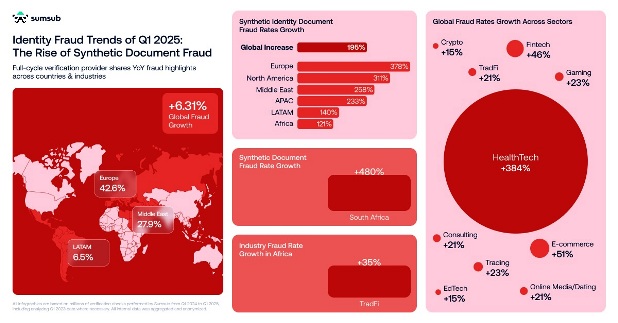

But while traditional fraud methods like document forgery collapsed across the African continent, synthetic identity document scams surged dramatically in some key markets, signaling a pivotal shift in criminal tactics. Some of the key highlights are the following:

REGIONAL FRAUD RATE TRENDS

These statistics indicate the proportions of fraudulent attempts blocked by Sumsub’s verification platform, out of all verification attempts in the specified country over the indicated period.

| Country | Fraud Rate (Q1 2025) | YoY Change |

| Nigeria | 4.44% | +2.5% |

| Tanzania | 4.89% | +9.6% |

| South Africa | 0.90% | -26.2% |

| Kenya | 3.05% | -15.5% |

When examining major economies, the differences are particularly striking. Nigeria’s fraud data presented a mixed picture: while the overall fraud rate saw a slight increase, many specific types of fraud decreased. Notably, the document forgery fraud rate in Nigeria plummeted by roughly 80% year-on-year. South Africa experienced a decline in total fraud proportion, dropping by 26%, with the document forgery rate falling by over 73%.

In contrast, Ghana and Tanzania partly diverged from the regional trend; both recorded double-digit increases in their overall fraud rates (around 10% each), yet Ghana saw its document fraud rate decrease by nearly 50%. Meanwhile, Kenya’s overall fraud rate fell by 15.5%, with document-forgery fraud declining by 45%.

FRAUD TYPES PER REGION

Africa’s fraud landscape underwent a fundamental transformation in Q1 2025, marked by the near-collapse of traditional scams and the rapid emergence of digital-era threats:

Document Forgery

Africa is leading in the decline of traditional forgery with fraudsters now forced to use new technology to bypass verification systems, including synthetic document fraud.

Overall, continental document fraud rates plummeted 82% year-on-year from 0.51% in Q1 2024 to 0.09% in Q1 2025. Leading economies drove this decline:

- Nigeria: Approximately 80% reduction

- South Africa: Over 73% drop

- Ghana: About 50% decrease

However there has been a rise in synthetic identity documents involving fabricated credentials and AI-created documents. There has been a significant increase in some markets, but very low levels in general:

- South Africa: Synthetic document fraud remains low at below 0.3% of all verification attempts. But its growth rate in this regard stands at an alarming 480%.

- Tanzania: The same attack type represents more than 2% of all verification attempts, having grown 184% year-on-year.

- Nigeria: 192% increase to over 1.5% of all verification attempts.

FRAUD PER INDUSTRY

Some industries reported slight increases in exposure to identity fraud, while others reported significant decreases across the African continent:

| Sector | Q1 2025 Rate | YoY Change |

| Traditional Finance | 3.22% | +35% |

| Fintech | 3.16% | +7.1% |

| IT Services | 0.28% | -90% |

| Gaming | 4.33% | -48.6% |

| Online dating & Social media | 5.73% | -36.8% |

| Crypto | 4.18% | +2% |

| Professional & Consulting Services | 5.66% | +11.2% |

Statistics show that Africa is following the rising global trend in the production of fraudulent synthetic identity documents, but does not stand out from its counterparts.

However, as we look at Q1 2025 fraud rates, the data indicates that some industries show alarmingly high proportions. For instance, for online dating & social media platforms, as well as professional & consulting services in Africa, almost 6% of all verification attempts were fraudulent in the last quarter. As for gaming, fintech, crypto and traditional finance, the identity fraud among those is also disturbing, constituting around 3-4% of all attempted KYC checks.

“Africa’s fraud landscape is undergoing a seismic shift. Enhanced verification tools have decimated traditional document forgery, but criminals are adapting with synthetic IDs and AI-powered scams. While countries like South Africa show impressive progress, financial institutions must urgently prioritise digital identity threats. The data proves that fraud prevention is now a race between innovation and adaptation” said Hannes Bezuidenhout, Sumsub’s VP of sales for Africa.

To combat evolving fraud risks, businesses must adopt cutting-edge technology that ensures security while maintaining compliance with regulatory standards. Across Africa and other key markets, fraudsters are shifting from conventional scams to sophisticated synthetic identity document fraud, making robust verification solutions more critical than ever.