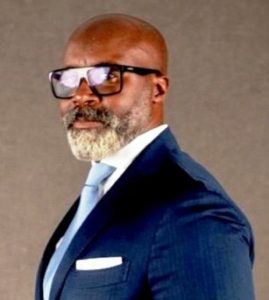

The Silverbacks Valley podcast hosted by Ibrahim Sagna

Welcome to Silverbacks Valley, where we embark on a compelling exploration of the dynamic intersection between technology and finance in Africa. In a continent marked by limited infrastructure, fintech has emerged as a transformative force, laying the groundwork by establishing the digital layer as a foundational step. This journey began with revolutionizing payments and gradually evolved to leverage customer relationships and data, expanding and tailoring services to reach traditionally excluded customers.

RELATED: Fintechs are set to transform cross-border payments in Africa

Our host, Ibrahim Sagna, a seasoned professional with a diverse career spanning investment banking, private equity, and hedge funds, is on a mission to reshape global perceptions of Africa. With a key role in transactions exceeding $30 billion, Ibrahim shares his insights into the profound impact of technology on financial services, with over 50% directed towards telecom and finance. In the realm of venture capital, Ibrahim highlights a significant 70% allocation to fintech, emphasizing the transformative role technology plays in reshaping traditional financial services and paving the way for the emergence of new unicorns.

Africa’s Demographics and Tech Growth

As we delve into this fascinating landscape, consider the demographics shaping Africa’s trajectory. According to the United Nations, the continent is home to 1.2 billion people, with 70% of the population under 35, and over 40% under the age of 15. Projections indicate that by 2050, Africa will constitute 25% of the world’s population.

In addition to the demographic boom, the technological landscape in Africa is experiencing significant growth. According to a GSMA report, mobile penetration is projected to reach 50% by 2030 up from 43% in 2023. Take Nigeria as a notable example, where mobile penetration has surged from less than 5% to an impressive 87.7% of the population after the entry of GSM. This transformative shift not only enhances awareness but also paves the way for easy access to payment and banking solutions, showcasing the profound impact of technological advancements in the region.

Fintech’s Role in Financial Inclusivity

Fintech has played a pivotal role in expanding financial inclusivity across Africa. It has provided opportunities for individuals once excluded from traditional banking systems to earn, save, and borrow. Despite notable advancements, a substantial untapped global demand for financial services persists. Join us as we unravel the stories, innovations, and challenges shaping the fintech landscape in Africa and discover the untapped potential that lies ahead.

Africa’s Fintech Boom

Explore the ever-evolving terrain of the African fintech market, poised for substantial growth in the coming years. Projections indicate a remarkable expansion, making it the world’s fastest-growing region in the fintech industry. African startups achieved record fundraising in recent years despite global slowdown in tech funding, securing substantial capital, a significant portion of which flowed into financial services companies. This surge in investment signifies the market’s robust momentum, indicative of its emergence as a key player in the global fintech landscape.

The “Big Four” comprising of Nigeria, South Africa, Kenya, and Egypt dominated the African fintech landscape, housing 77% of the continent’s fintech companies and securing over 90% of the total funding between 2021 – 2023. Notably, Nigeria led the charts with an impressive 32% market share, surpassing $1 billion in venture capital funding, and boasting a noteworthy 217 established fintechs. Following closely, South Africa had 140 firms, Kenya with 102, and Egypt with 65 during the same period.

Major Fintech Deals in 2023

In 2023, African fintech raised an impressive $1.6 billion in equity and debt, with $900 million in equity. Notably, 75% of the equity funding was concentrated among the top ten companies in the sector.

In February 2023, the Egyptian fintech and e-commerce ecosystem MNT-Halan raised over 400 million in equity and debt financing from local and global investors as it continued to serve underbanked and unbanked customers in the North African country. The round included $260 million in equity financing and $140 million through two securitized bond issuances secured within the past year, investments that will now see MNT-Halan command a post-money valuation of about $1 billion.

South Africa’s first digital bank, Tyme Bank, secured $260 million in funding across four rounds which included a significant $78 million in May 2023. With potential funding of $100 million in 2024, the company valuation aims to cross the $1 billion mark, making it the first announced African unicorn in 2024. Tyme Bank plans to allocate a portion of the fresh funding for its expansion into Vietnam, tapping into the fast-growing $470 billion economy with a youthful population and low unemployment.

In August 2023, Moove, a “Nigerian born” stellar fintech venture within the portfolio of Silverbacks Holdings, demonstrated its unwavering success by securing an impressive $76 million in a fresh fundraising round. The sum consisted of $10 million in venture debt from BlackRock-managed funds and accounts, $28 million in equity from new and existing investors led by Mubadala Investment Company, and $38 million in previously undisclosed money raised over the preceding 12 months. Specializing in mobility solutions in the African market, Moove distinguishes itself by offering financing options for drivers affiliated with gig networks and leading ride-hailing services, including the likes of Uber, Grab and others. This substantial fundraising achievement attests to Moove’s pivotal role in the innovative landscape of African fintech and its commitment to revolutionizing mobility financing. Moove is one of our strongest conviction within our fintech portfolio. We invested in the company when the valuation was 10X below current levels, and kept double down.

Conversation with The Queens of African Fintech

In our engaging discussion with Agnes Aistleitner Kisuule and Selma Ribica from First Circle Capital, we uncovered their distinctive investment approach, extending beyond cash to provide portfolio companies with access to a network of experienced experts. Their platform benefits from the vast industry expertise and network Selma Ribica who has multiplied her angel portfolio 33X MOIC in early stage fintech, she was an early backer in companies such as Qonto, Tabeo, Expensya which was just recently sold to Medius. Their virtuous strategy involves guiding founders not just through the initial stages but throughout the entire growth journey, leveraging the expertise of investors with significant fintech experience.

They emphasized the strategic importance of payments while acknowledging the challenges in making these businesses profitable. With a focus on the African market, they favor credit-led models and expressed interest in innovative solutions for B2B needs and insurtech. This conversation offers a sneak peek into the forward-thinking strategies shaping the future of fintech innovation in Africa with First Circle Capital at the helm.

Join us on this journey of financial innovation in Africa with Agnes and Selma from First Circle Capital. Revisit this insightful episode to discover the strategic foresight, their approach to portfolio construction and the transformative ideas shaping the future of fintech.

Silverbacks Valley is a podcast focused on bridging the worlds of VC, tech, sports, media & lifestyle in Africa. The host, Ibrahim Sagna, is an investor, a seasoned professional with a diverse career spanning investment banking, private equity, and hedge funds.