Impact investor and development financier Finnfund has put digital infrastructure and solutions at the heart of its new strategy. According to the World Bank, a ten percent increase in digital connections leads to a 2.5 percent increase in GDP. Nothing works or grows in isolation without connections.

RELATED: Funding Nigeria’s digital gap

“A developing country falls further into the outer reaches of development if it is not properly connected to the surrounding world. If connections at the state level are weak, it puts the entire society and its citizens in an unequal position”, describes Investment Manager Kuutti Kilpeläinen.

High cost of infrastructure: The price of devices and data

The glaring problem is that up to 3 billion people do not take advantage of connections, even though it would already be possible for them in terms of infrastructure.

”The main reason for this is the price of devices and data. That is why Finnfund, as a technology-driven impact investor, invests in solutions that lower prices for consumers without compromising on the speed of services and the quality of technology.”

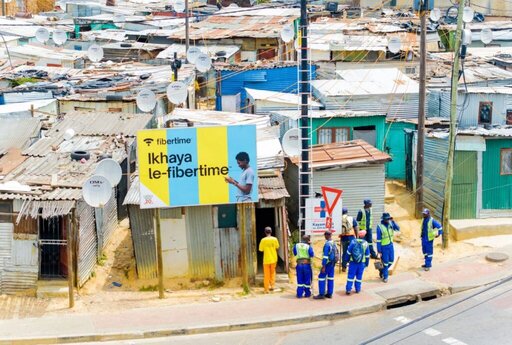

An example of Finnfund’s investments is the South African company Fibertime, which offers high-quality network connection and technology to the poorest areas of South Africa.

At the heart of the solution is both an affordable pricing model, pay-as-you-go, and the Finnish Nokia technology used. Consumers do not have to commit to expensive permanent contracts, but only buy a connection as needed, on a time basis.

Operating in a market of low income

“Fibertime operates in a market where local residents have an income level below the poverty line, and high-quality network connection has not previously been available. Therefore, the indirect and direct impacts of the service are very significant: Internet access creates jobs, grows business, and opportunities to acquire information, study, and communicate.”

Fiber networks have previously been seen as a niche market, but now they enable people to access high-quality services cost-effectively in developing markets. Where are the greatest opportunities for development finance to make productive investments now?

“The ongoing market turbulence and uncertainty are directly reflected in developing countries. While no one can know for sure how tariffs will affect exchange rates and individual countries, the telecom sector has traditionally been defensive and has grown despite market volatility, driven by digitalisation”, says Kilpeläinen.

According to Kilpeläinen, Finland has a huge amount of technological expertise in online business, data centers, cybersecurity and payment services. Finland’s position as a strong technology exporter is recognised worldwide and it creates opportunities for Finnish companies.

Financing companies in markets with financing gap

Finnfund’s competitive advantage is its ability to provide financing to medium-sized companies in markets where the financing gap is greatest. “Finnfund is closely following the discussion around tariffs and assessing target markets in detail. Investments will continue, but macro analysis is increasingly important when choosing investment targets.”

There are always three conditions for companies to receive financing: Projects must be profitable, impactful and sustainable. “We have good partners in both the industry and investor sides – that gives us a competitive advantage. Our multi-instrument mandate, equity, mezzanine and loan, enables broader sourcing. Our market reputation and sector expertise is strong, especially in Africa, and helps us to differentiate Finnfund from peers.”

Bridging the digital divide is a huge business opportunity, while also producing significant impact benefits for people’s well-being and livelihoods. “Digital cohesion is the foundation of the entire economy and society”, summarises Kilpeläinen.