Robust Growth Forecast for Fixed Communications

According to a new forecast from GlobalData, a leading data and analytics company, South Africa’s fixed communication services revenue is set to grow at a compound annual growth rate (CAGR) of 4.1% between 2025 and 2030. This sustained growth highlights the increasing importance of reliable, high-speed connectivity in the country’s digital economy.

RELATED: Finnfund’s Kuutti Kilpeläinen: Fibre networks are the top impact investment for 2025

Fiber-Optic Broadband Emerges as Primary Growth Engine

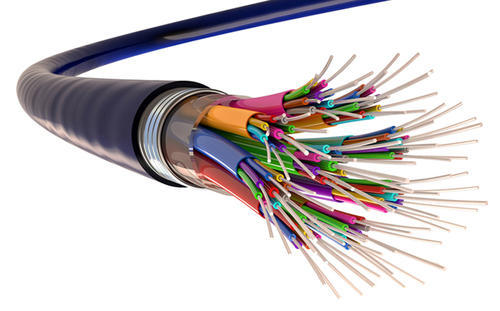

The analysis identifies fiber-optic broadband (FTTH/B) as the key driver of this expansion. Accelerating nationwide fiber rollouts are expected to capture significant market share, delivering the high-speed, high-capacity connections demanded by households and businesses. This fiber-led push is central to the sector’s positive revenue trajectory.

GlobalData’s South Africa Fixed Communications Forecast (Q3 2025) reveals that fixed voice service revenue will grow at a CAGR of 2.8% over the forecast period, supported by the continued growth in VoIP subscriptions. This growth will be driven by the expansion of fixed broadband networks across the country, enabling high-quality VoIP services for both residential and business customers.

Fixed Wireless Access to Bridge the Digital Divide

While fiber leads the charge, Fixed Wireless Access (FWA) is forecast to play a critical complementary role. FWA technology is highlighted as a vital solution for providing connectivity in underserved and remote areas, where laying fiber infrastructure may be less immediately viable. This dual-track approach aims to boost overall internet penetration across South Africa.

FWA lines will also grow at a five-year CAGR of 9.1%, supported by the growing demand for high-speed internet services in areas with limited fiber coverage and the emergence of FWA as an alternative for wired broadband connections in such areas.

Fixed broadband service revenue, on the other hand, will increase at a reasonably faster CAGR of 4.4% during the review period, supported by the growth in fiber-optic (FTTH/B) and fixed wireless access subscriptions.

Neha Mishra, Telecom Analyst at GlobalData, comments: “Fiber lines accounted for about 65.3% share of total fixed broadband lines in 2024 and will remain the leading broadband technology through to 2029. This growth will be driven by the rising demand for high-speed broadband connectivity and government and operators’ focus on expanding fiber network coverage and promoting the adoption of FTTH/B services across the country.”

For instance, in July 2025, the government allocated ZAR710 million ($37.9 million) to the SA Connect Programme to accelerate the rollout of fiber broadband infrastructure across schools, clinics, and underserved communities, supporting nationwide digital inclusion.

Mishra concludes: “Telkom led the fixed broadband services market in 2025 and is expected to maintain its leadership through 2030, given the company’s substantial investments in broadband infrastructure. During FY2025, Telkom allocated approximately 27% of its total capital expenditure to fibre deployment, accelerating its transition from legacy copper to next-generation broadband.”