By Eric Osiakwan

The exit trail took an unusual turn in late December when African telecom Billionaire, Strive Masiyiwa, announced that Econet Wireless Zimbabwe Limited would delist from the Zimbabwe Stock Exchange, after years of trading at a steep valuation discount to regional peers, which trade at 6–8 times EV/EBITDA.

RELATED: Move over Asia, Africa is next big deal for innovation and economic growth – Osiakwan

ALSO READ: Exiting December 2025

He said “the decision forms part of a broader corporate restructuring aimed at unlocking value” as follows; 1. Spinning off its infrastructure assets into a new entity called Econet Infrastructure Company Limited (Econet InfraCo). 2. Econet InfraCo will hold its towers, real estate, and power assets, with 70% owned by Econet and 30% available for shareholder settlements. 3. Econet InfraCo will be listed on the Victoria Falls Stock Exchange (VFEX).[1] So the delisting would lead to another IPO to prop up a rather small and unknown VFEX – keeping the momentum of IPOs into 2026.

Nigerian Equities Maintain Bullish Run in December

The Nigerian equities market on the other hand sustained its bullish momentum in December, as renewed buying interest in fundamentally sound stocks lifted key indicators. For example, the NGX All-Share Index advanced by 0.31 percent to close at 150,302.32 basis points, pushing the year-to-date return to about 46 percent.

Market capitalisation rose by 0.35 percent to N95.86 trillion, translating to a N331.63 billion increase in investors’ wealth and underscoring improving confidence despite a sharp drop in market activity. Looking ahead, analysts expect trading to remain cautious in the near term, with investors likely to focus on stocks with strong fundamentals and attractive valuations.

While activity levels may remain muted, the positive market breadth and sustained institutional interest suggest the broader bullish trend could be maintained in 2026, barring adverse macroeconomic shocks.[2]

Fintech M&A: ArifPay Acquires Majority Stake in Ethiopian Jami

On the the mergers and acquisition front, ArifPay, a four-year-old financial technology company, has acquired a majority stake in Jami, an Ethiopian virtual tipping platform founded by Nathan Damtew, for 16 million Birr. The deal marks a strategic expansion for the fintech company, which has increasingly broadened its business portfolio from its primary offering as a payment operator.

Jami, founded to facilitate digital tipping for creators has positioned itself as a bridge between Ethiopia’s cash-dominated informal economy and the country’s growing digital payments ecosystem. The platform has gained traction by enabling small-value transfers in everyday setting, including cafés, delivery services, and entertainment venues.

The acquisition allows Jami to leverage ArifPay’s payment infrastructure and merchant network, while ArifPay gains access to a social-payments layer that could increase user engagement and transaction frequency.[3] This is the first of such transaction in the young Ethiopian tech ecosystem – creating a promising 2026. Whiles SA leads M&A in Africa[4], it is great to see newcomers.

Vodacom’s Majority Acquisition Could Reshape Safaricom Culture

Staying in East Africa, my “Exiting December 2025” essay,[5] which cited an anylysts’ submission that the majority acquisition of Safaricom by Vodacom, could change the corporate culture at Safaricom was met with cynicism.

Specifically, citing Vodacom’s own legal battle in the South African courts with a former employee, Nkosana Makate, who claimed to have invented the popular “Please Call Me” service in 2000 when he was an employee and was promised compensation for same after launch in 2001 but have been involved in a protracted court battle.

In 2024 as a result of the deadlock in determining Makate’s compensation, the case went to the Supreme Court of Appeal. There, Vodacom was ordered to pay Makate 5% to 7.5% of the total revenue generated from “Please Call Me” since its 2001 launch, plus interest. The actual figure for the compensation sits anywhere between R29 billion and R186 billion. Vodacom said “nope” and appealed the case back to the Constitutional Court.

Coincidentally, on November 6th 2025, the same day a Kenyan court overturned the arbitration award against Popote in favor of Safaricom, the Constitutional Court in South Africa also ruled in favor of Vodacom, saying that it was unhappy with numerous elements of the Supreme Court of Appeal’s ruling.

It ordered the case back to the Supreme Court, where it will be presided over by a different set of judges.[6] Now, “would Vodacom’s majority acquisition of Safaricom change the corporate culture given that the company is embroiled in a similar situation?”

The push back by people familiar with both matters is that, the corporate culture would only change if Vodafone begins to feel the dent on their global reputation as a corporate shark – then and only then would things change as it would affect their enterprise value.

Corporate Goliaths vs. Startup Davids: The Battle in Court

However, there is a larger fiduciary duty of the courts as independent arbiters of justice. Both cases pitch a corporate goliath with a formidable war chest against a startup with next to no resources but a Davidian sling.

With limited financial or legal muscle, Makate had to procure Black Rock Mining to fund his uphill litigation.[7] In Kenya, Popote has funded its own legal battle since 2022, shifting resources away from investments necessary for growing the business.

As the adadge goes, “justice delayed is justice denied. One hopes that the courts are not allowing undue delay tactics and legal technicalities to obstruct the primary goal of achieving “substantive justice” in the two landmark cases. The business community looks forward to a cleaner judiciary in 2026 and beyond.

Ghana’s Cedi Ranks Among World’s Top Performing Currencies in 2025

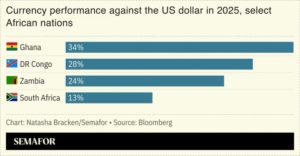

The late December listing on the Ghana Stock Exchange by the 30-year-old First Atlantic Bank is set to stir further activities on the Accra-based bourse in 2026. Until now, MTN Ghana (aka Scancom limited) was the last company to list on the bourse – generating massive activities, given its yearly dividend-issuing policy since going public. Ghana’s cedi emerged among the world’s best performing in 2025, driven by soaring commodity prices and rising economic stability.

Ghana’s Virtual Asset Regulation Begins with 2025 VASP Bill

Still in Ghana, Parliament passed the Virtual Asset Service Providers (VASPs) Bill to see 2025 off, establishing a formal legal and regulatory framework for virtual assets and related service providers in Ghana, the Bank of Ghana (BoG) announced.

Under the legislation, individuals and entities engaged in virtual asset activities like crypto will be required to obtain a licence or register with either the Bank of Ghana or the Securities and Exchange Commission (SEC), depending on the nature of their operations. The BoG said it will work closely with the SEC to issue directives and supporting regulatory instruments in the coming months to operationalise the Act, provide guidance to applicants, and clarify licensing and compliance requirements.

“The Bank of Ghana and the Securities and Exchange Commission reaffirm their commitment to a safe, transparent and innovative virtual asset ecosystem that protects users and safeguards the financial system,” the notice said.[8] This sets the stage for legal crypto activities in Ghana going forward from 2026 – changing the prospects of Ghana’s position in the global digital economy.

[1] https://africa.businessinsider.com/local/markets/billionaire-strive-masiyiwas-econet-wireless-to-delist-plans-infrastructure-unit/7krlmtx

[2] https://www.zawya.com/en/economy/africa/nigerian-equities-extend-rally-as-ngx-as-investors-earn-2271mln-gmjl572x

[3] https://www.shega.co/news/arifpay-acquires-majority-stake-in-ethiopian-tipping-platform-jami-in-a-multimillion-birr-deal?mc_cid=29d9a1d08d&mc_eid=40087f4350

[4] https://techcabal.com/2022/08/26/south-africa-tech-mergers-and-acquisitions/

[5] https://www.myjoyonline.com/exiting-december-2025/

[6] https://techaways.substack.com/p/vodacom-and-please-call-me-inventors

[7] https://www.moneyweb.co.za/news/south-africa/court-rejects-urgent-application-to-freeze-40-of-makates-please-call-me-winnings/

[8] https://norvanreports.com/parliament-passes-vasps-bill-as-bog-sec-move-to-regulate-virtual-asset-industry/