By Ethan Phillips, Technology Analyst, IDTechEx

For years, emerging memory technologies such as MRAM, ReRAM, FeRAM, and PCM have been pitched as game-changing solutions, combining the persistence of Flash with the speed and endurance of DRAM. These technologies were expected to disrupt the traditional memory hierarchy.

RELATED: Smarter memory paves way for EU independence in computer manufacturing

However, commercial success has been elusive despite significant technical advantages, as discussed in the IDTechEx market report “Emerging Memory and Storage Technology 2025–2035: Markets, Trends, Forecasts“. A key example is Intel and Micron’s Optane, which introduced PCM capable of bridging the gap between volatile and non-volatile memory.

Traditional memory industry has decades of ecosystem development

Despite its promise, Optane failed to scale commercially. The underlying issue was not performance but economics. The traditional memory industry has decades of ecosystem development and manufacturing scale behind it. Any new memory technology enters the market with low production volumes and a lack of ecosystem support. This creates a production-cost trap: low volume leads to high prices, which suppresses demand and prevents scale-up. The result is a self-fulfilling failure to gain traction, even when the technology itself is superior.

Rather than continuing to challenge incumbent memory types head-on, many developers of emerging memory have shifted their focus. Increasingly, they are targeting embedded applications where legacy technologies such as embedded Flash and NOR Flash are struggling to keep pace.

These embedded solutions, widely used in microcontrollers and other system-on-chip designs, face fundamental scaling challenges as semiconductor processes move below the 28-nanometer node. In contrast, emerging memory technologies offer fast access times, high endurance, better power efficiency, and superior scaling potential. This makes them a natural fit for embedded systems.

Emerging memories provide a viable path forward

“Emerging Memory and Storage Technology 2025–2035: Markets, Trends, Forecasts” provides an in-depth analysis of the evolving emerging non-volatile memory landscape. The report analyzes key technologies such as MRAM, ReRAM, FeRAM, and PCM, as well as the leading players commercializing them and their impact on cost, efficiency, and performance.

Embedded memory refers to memory integrated within a system-on-chip rather than existing as a separate module. It is used in microcontrollers, microprocessors, and field-programmable gate arrays. These embedded systems power applications across automotive, industrial, IoT, and edge AI.

As logic scales down, embedded memory must scale with it to maintain performance and integration efficiency. Emerging memories provide a viable path forward. They support smaller nodes, operate at lower voltages, and offer low latency access, all while retaining data without power. This combination is essential for next-generation embedded devices.

This shift toward embedded integration is already gaining real-world momentum. Companies are moving beyond research and into deployment, signaling the commercial viability of emerging memory. Everspin Technologies manufactures its own Toggle MRAM and has also partnered with GlobalFoundries to commercialize STT-MRAM at the 22 nm node. Weebit Nano is working with SkyWater Technology and GlobalFoundries to bring its ReRAM into volume production for embedded system-on-chip applications.

Foundries themselves are playing a key role in this transition. GlobalFoundries and TSMC offer 22nm ReRAM within their platforms. At the leading edge, Samsung has presented their 14 nm embedded MRAM, claiming the industry’s most energy-efficient write operation and the smallest MRAM cell size to date, measuring just 8 nm.

Embedded devices demand ultra-low power consumption

The applications driving this shift are diverse. In the automotive sector, electronic control units and advanced driver-assistance systems require memory that can tolerate high temperatures, provide low latency, and endure repeated write cycles.

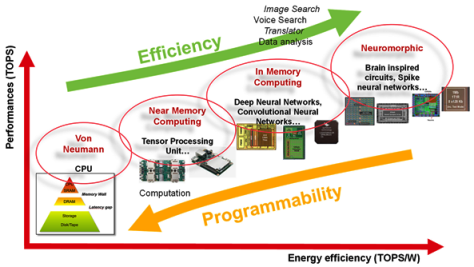

In the IoT sector, embedded devices demand ultra-low power consumption and high data retention. In edge AI, latency becomes a critical performance metric. Faster embedded memory can significantly improve inference performance and enable real-time decision-making directly on the device. Emerging memory technologies are well-positioned to meet all these demands.

Scaling embedded memory to advanced nodes is vital for modern semiconductor design. As system-on-chip architectures move below 28 nm, embedded memory must follow to avoid becoming a bottleneck. Smaller nodes allow higher memory density, which supports more complex processing tasks and reduces reliance on external memory modules.

This results in better performance, lower power consumption, and lower latency. Advanced nodes also improve cost efficiency by reducing the silicon area required per bit. Furthermore, modern CMOS processes are optimized for low-voltage operation, and emerging memories are better suited for these environments than legacy Flash.

Rise of embedded AI and smart edge devices

The rise of embedded AI and smart edge devices only accelerates this trend. Edge computing systems are increasingly expected to process data locally, reduce communication latency, and make real-time decisions. These systems require memory that is fast, energy-efficient, and non-volatile.

Traditional embedded memory solutions often fall short in one or more of these areas. MRAM and ReRAM are emerging as the leading candidates to replace NOR Flash and embedded Flash in these environments. They offer fast write speeds, low standby power, and long endurance. They also scale with advanced logic nodes, enabling seamless integration into cutting-edge chip designs.

While these technologies may not yet be ready to displace DRAM or NAND at scale, their success in embedded applications demonstrates a clear path to commercial viability. By targeting embedded systems first, developers can build manufacturing maturity, secure strategic partnerships, and establish themselves in segments where their performance advantages truly matter. The embedded route allows emerging memory to prove itself in real-world applications while avoiding the cost and ecosystem traps that derailed previous attempts at mainstream disruption.

Emerging memory is becoming a present reality

Emerging memory is no longer just a future prospect. In embedded systems, it is becoming a present reality.

Emerging Memory Market Forecast, more details can be found in IDTechEx’s latest research: Emerging Memory and Storage Technology 2025–2035: Markets, Trends, Forecasts: Technologies, Markets, and Forecasts

Learn more in IDTechEx reports

For those looking to understand the full picture, IDTechEx’s new report, “Emerging Memory and Storage Technology 2025–2035: Markets, Trends, Forecasts“, offers the most comprehensive assessment to date of how non-volatile memory is evolving and where commercial traction is taking hold. The report includes:

- Detailed analysis of MRAM, ReRAM, FeRAM, and PCM technologies and their performance trade-offs

- Profiles of key players, including start-ups and global foundries, with market deployment roadmaps

- Use-case deep dives in automotive, industrial, IoT, and AI edge computing

- Forecasts and adoption outlooks through 2035 for embedded memory and emerging NVM

Whether you’re a semiconductor manufacturer, embedded systems designer, IP vendor, or strategic investor, this report delivers the insight you need to navigate the next decade of innovation in memory. Discover how emerging technologies are reshaping the embedded landscape and what it means for your business.