By Osasómé C.O

Landmark Tax Reforms to Take Effect January 1, 2026

From January 1, 2026, Nigeria’s bold move to modernize its tax system and boost revenue generation will go into effect. The Federal Government of Nigeria has already announced that a new progressive tax regime for individual income will come into effect.

RELATED: Nigeria to enforce mandatory tax ID for financial services from 2026 under new tax law

However, what truly sets this reform apart is the central role of digital technology in its implementation, oversight, and enforcement.

Leveraging Technology to Transform Tax Administration

The tax reform is driven by a comprehensive digital transformation agenda. This is aimed at improving transparency, broadening the tax base, and curbing decades-long leakages.

Key Digital Initiatives Include:

-

Rebranding of FIRS to NRS: The Federal Inland Revenue Service (FIRS) has been renamed the Nigeria Revenue Service (NRS). It will help to consolidate tax functions and eliminate redundancy across agencies.

-

Mandatory e-Invoicing and Real-Time VAT Reporting: Launched in April 2025, the FIRSMBS platform requires large taxpayers to submit real-time e-invoices. Medium-sized businesses will join the system in 2026.

-

Unified Digital Tax ID System: All taxpayers must obtain a Tax Identification Number (TIN). The TIN will be used for all tax filings — from VAT, WHT, CIT, to Capital Gains Tax (CGT) — through an integrated online portal.

-

Bank Verification of TINs: Nigerian banks are now required to verify TINs for all account activities. Non-compliance may lead to restricted access to financial services.

-

Digital Payment Integration: Fintech platforms like Flutterwave are supporting the digitization of tax payments, making it easier for individuals and businesses to stay compliant.

A System Designed to Be Smarter, Fairer, and Tougher

The digitization of tax administration is expected to usher in several critical benefits for Nigeria’s fiscal future.

Simplification and Ease of Compliance

Taxpayers will be able to file, pay, and track taxes online without visiting tax offices, reducing inefficiencies and the risk of corruption.

Improved Compliance and Reduced Leakages

Automation and digital recordkeeping will reduce tax evasion and eliminate revenue leakages caused by manual processes.

Wider Tax Base and Digital Economy Inclusion

The reforms target previously untaxed segments, including freelancers, influencers, and digital creators. All of of this category of income earners must now self-declare income or face fines and penalties.

Transparency and Accountability

Real-time tracking, e-invoicing, and unified records ensure a clear audit trail and make it harder for revenue collection agencies to divert funds.

Plugging Decades of Revenue Leakages

One of the most significant impacts of the new tax system is its effort to stop the decades-long leakage of public funds by revenue collection agencies.

Between 1999 and 2023, agencies like FIRS, Customs, and DPR allegedly retained over $20 billion as “commissions.” According to government sources, the Tinubu administration aims to permanently end this practice. Here’s the ace card: government is creating a single digital revenue window, closing all loopholes for off-book transactions.

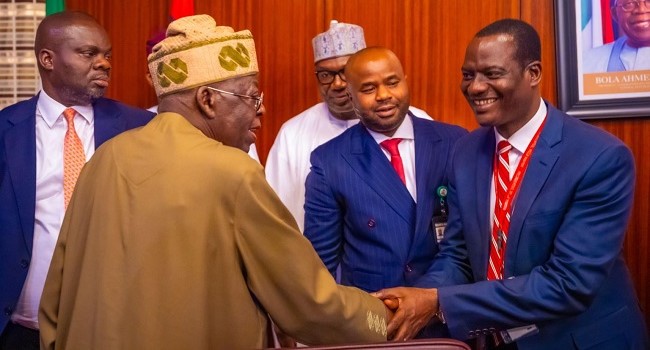

This journey for reform started June 26, 2025 when President signed four historic laws into effect. These are the Nigeria Tax Act (NTA), Nigeria Tax Administration Act (NTAA), Nigeria Revenue Service Act (NRSA), and Joint Revenue Board Act (JRBA). They are collectively referred to as “the Acts.”

Closing In on the Informal and Offshore Economy

Targeting Freelancers and Digital Workers

According to Taiwo Oyedele, Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, self-employed individuals, including those working remotely or online, will be required to declare their income annually. Failure to comply could lead to penalties ranging from ₦50,000 to ₦1 million, or up to three years in prison.

When self-reporting fails, the government will rely on “system validation”, a mechanism that cross-checks data using local and international sources, including Google and Meta payment records.

Global Information Exchange

Nigeria’s tax authority already participates in over 100 international data-sharing agreements, enabling it to track offshore income and enforce compliance among Nigerians earning abroad.

Challenges on the Horizon

While the plan is ambitious, experts highlight several potential implementation hurdles:

- Infrastructure Gaps: Full-scale rollout will require robust internet infrastructure, digital literacy, and system resilience.

- Risk of Centralization: Some stakeholders worry that over-centralization may marginalize state tax authorities and reduce local accountability.

- Unbanked and Informal Sector: Heavy reliance on digital systems may exclude informal workers and the unbanked population, unless inclusive mechanisms are introduced.

Why Digital is Central to Reform Success

The success of Nigeria’s 2026 tax reforms depends not only on the legal framework but on how effectively digital tools are deployed to deliver efficiency, fairness, and transparency.

President Bola Ahmed Tinubu, drawing on his success in growing Lagos State’s Internally Generated Revenue (IGR) by over 28,000% in 25 years, believes that digital governance is the cornerstone of effective public financial management.

These reforms are expected to save Nigeria over $2 billion annually and set the foundation for a more self-reliant, transparent, and economically resilient nation.