Chimoney, a payment infrastructure and API fintech for global money movement, has chosen WireFX, a SaaS platform empowering financial technology companies to build innovative payment experiences, as its US provider of payment and account services.

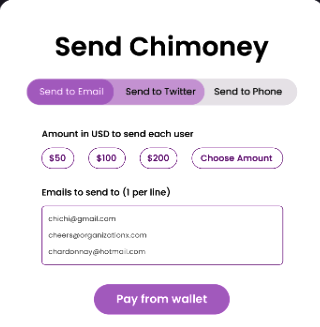

By providing connectivity to the US banking system, the WireFX platform will give Chimoney’s corporate clients the ability to seamlessly fund their Chimoney-enabled bulk payouts to community members, employees, contractors, and brand ambassadors around the globe.

RELATED: What will be defining fintech trends of 2023?

“Our Partnership with WireFX aligns with Chimoney’s mission to unlock economic opportunities for everyone since WireFX combines the best of banking services and easy-to-integrate technology. We are pleased with the team at WireFX and are looking forward to collaborating with WireFX to issue FDIC-Insured For-Benefit-Of (FBO) Bank accounts to our corporate clients, simplify the process of moving money globally, and increase trust between Chimoney and our clients,” said Uchi Uchibeke, Chimoney founder and CEO.

Chimoney is focused on building a world-class platform and payment infrastructure for businesses to enable fast, secure, and efficient global bulk payments, with an API for connecting multiple currencies, payment networks, and flexible, world-class cashout options including 1,000+ global gift card products, airtime in 10 countries, mobile money in 21 countries, and 10,000+ banks in 20 countries.

“We are excited to have our modern payment platform be chosen as part of Chimoney’s innovative payments experience,” said Jeff Althaus, WireFX President & CEO. “We look forward to working closely with Chimoney and growing a successful and long-standing partnership.”

WireFX is focused on providing fintechs such as Chimoney a full suite of compliance, account, and global payment rails in an all-in-one platform. With a modular API-based platform, fintechs can easily customize WireFX to deliver the experience their clients demand in a few weeks – not years.