- Survey shows 94% of firms will spend more this year with nearly one in five increasing spending substantially

- Nearly six out of 10 say their senior management are very committed to using alternative data

Professional investors across hedge funds, asset managers, and pension funds are poised to significantly increase spending on alternative data in 2026, driven by surging demand and strong senior management support for its integration into investment research.

RELATED: Investment manager alternative data budgets continue to expand

That’s the core finding from new research published by Exabel, a leading alternative data insights and analytics platform.

The global study surveyed senior investment professionals in the US, UK, Hong Kong, and Singapore, representing organisations with approximately $2.4 trillion in combined assets under management.

Budgets Rising Across the Board

The research reveals unanimous growth in alternative data investment:

- 94% of fund managers and investment analysts surveyed expect spending to increase this year compared to 2025

- 18% predict a substantial increase

- 100% of firms surveyed confirmed spending has already risen in recent years

This year’s projected growth builds on significant expansion already underway. More than half (54%) of respondents say budgets for buying and managing alternative data have increased by 50% or more over the past two years. One in 20 reported that their budgets had more than doubled during that period.

Senior Management Fully On Board

The research found near-universal commitment from leadership teams:

- 58% say senior management are “very committed” to using alternative data

- 42% say senior management are “quite committed”

This level of executive buy-in underscores the growing recognition of alternative data as a critical component of modern investment research.

How Much Are Firms Spending?

According to Exabel’s Alternative Data Buy-side Insights & Trends 2026 report:

- 84% of organisations surveyed spend between $500,000 and $2.5 million annually on alternative datasets

- 4% spend more than $2.5 million per year

These figures point to meaningful but disciplined investment levels, suggesting firms are scaling their alternative data capabilities thoughtfully rather than indiscriminately.

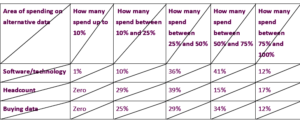

The table below shows how investment organisations surveyed estimate spending on alternative data management, staffing and datasets breaks down.

What the CEO Says

Tim Harrington, CEO of BattleFin & Exabel, commented:

“Budgets for alternative data are set to rise this year and senior management commitment to the use of this insight in investment research is high.

“Most of the investment organisations we surveyed currently spend between $500,000 and $2.5 million a year on alternative datasets, indicating meaningful but disciplined investment levels.”

Report Methodology

The findings are drawn from Exabel’s report Alternative Data Buy-side Insights & Trends 2026, which examines how investment firms are allocating resources to alternative data acquisition, management, staffing, and analytics.

COVER IMAGE: AXSMarine