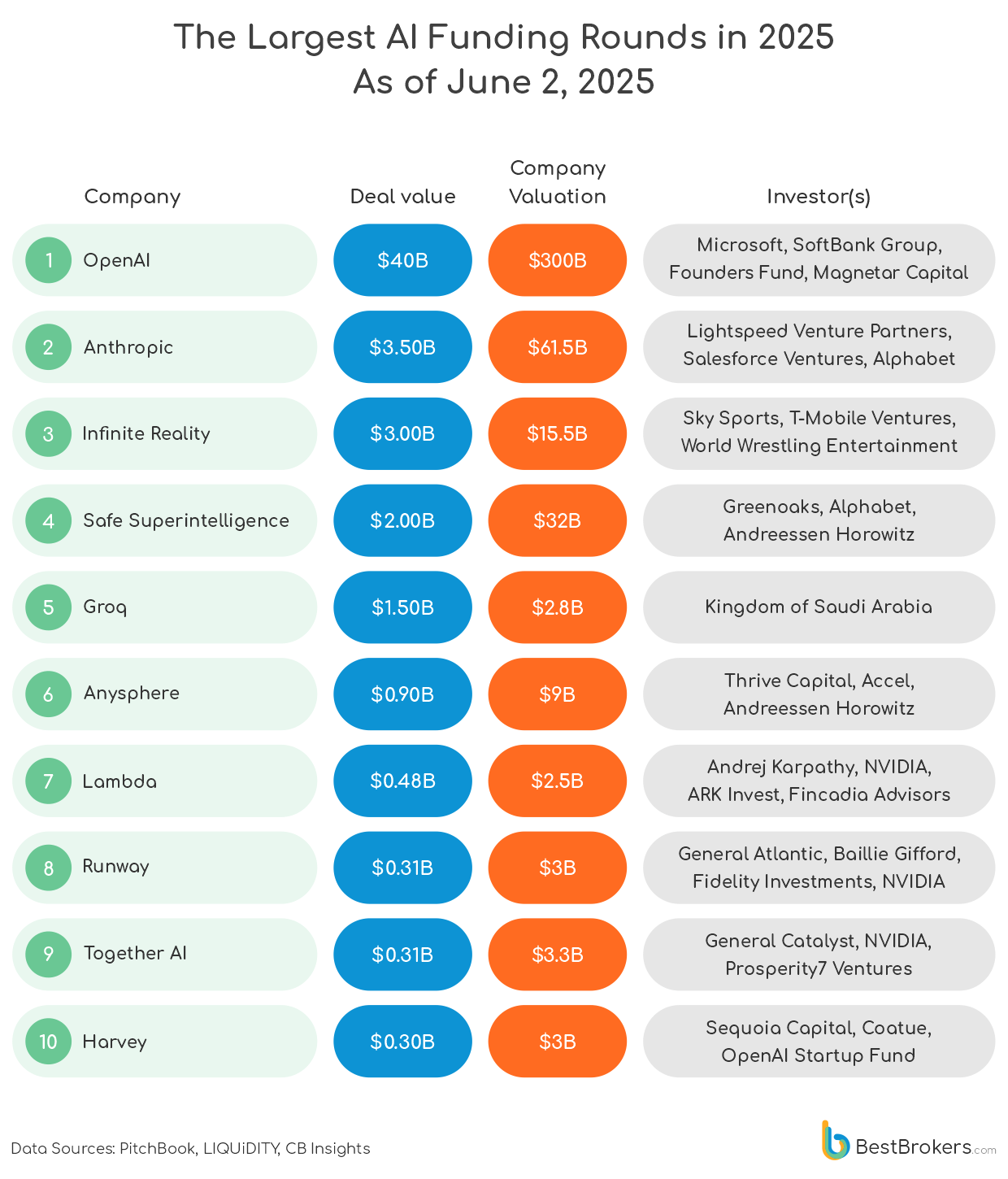

Attracting millions of dollars in funding, AI startups are now the superstars of the tech industry, with OpenAI making history when they secured a staggering $40-billion investment from Softbank earlier this year. A recent report by BestBrokers that highlights the largest funding rounds in AI so far in 2025 provides more details about this and other major venture capital deals in artificial intelligence,

RELATED: More startups raising $1m+ in Africa

According to BestBrokers, artificial intelligence, large language models, and data centres are among the most promising and exciting industries nowadays, with the global AI market predicted to reach $4.8 trillion by 2033.

To identify the major AI investment deals in 2025 and track the shifting dynamics of venture capital in the sector, the team at BestBrokers collected investment and fund data from Pitchbook, CB Insights, and several other sources and analysed the latest financial disclosures from leading venture capital firms. All findings and datasets referenced in this report are available in full via Google Drive via this link.

Key takeaways

In the first three months of 2025, there were 2,101 VC-backed AI deals. Together, these deals brought in $73.1 billion, accounting for 57.9% of all venture capital funding this quarter.

- Japanese multinational investment holding company SoftBank’s recent $40 billion investment in OpenAI was the largest VC-backed deal of the year, and the biggest tech funding round ever recorded.

- Anthropic, the startup behind large language model Claude, raised $3.5 billion at a $61.5 billion post-money valuation in a funding round led by Lightspeed Venture Partners, with participation from Bessemer Venture Partners, Cisco Investments, D1 Capital Partners, Fidelity Management & Research Company, and others.

- Infinite Reality, which has only recently released its product (a 3D tool for businesses) received a $3 billion investment from an unknown contributor, raising the company’s valuation to $12 billion. There is currently ongoing speculation that the nameless investor could be connected to the real estate company Sterling Equities.

Venture capital activity in AI was relatively quiet in the first quarter of 2025, with just 7,551 deals recorded. Despite the lower deal count, total VC investment hit $126.3 billion, marking the highest quarterly value since 2022.

Decrease in global VC deal coincides with sharp investment increase in AI

The decrease in global VC deal count coincides with the sharp increase in investment value across the AI sector. Venture capital firms are beginning to grow more cautious of the startups they choose to fund. At the same time, major investors such as SoftBank, Andreessen Horowitz, and Lightspeed Venture Partners are doubling down on long-term investments in well-established AI unicorns like OpenAI and Anthropic.

More information on VC investments, major AI deals, and complete research methodology can be found in the full report.