AI investment heats up in June, according to a new report by BestBrokers.com.The firm shares some insights from it recent analysis on venture capital-backed AI startups and the largest funding rounds so far in 2025.

RELATED: AI sees bright future and increasing investments despite global risks

San-Francisco-based artificial intelligence startup Thinking Machines Lab just secured a $2 billion funding in the largest U.S. seed round of all time. Details of the massive deal are making headlines.

To showcase the current investment trends of major venture firms, the team at BestBrokers collected investment and fund data from Pitchbook, CB Insights, and several other sources and analysed the latest financial disclosures from leading venture capital firms. All findings and datasets referenced are available in full via Google Drive via this link.

Figures show that investment in AI has slowed down considerably since 2021, with only 2,101 deals in the first quarter of 2025. This 16.49% drop year-over-year points towards a sharp decrease in the aggressive early stage funding spree that had been the norm for years. However, funding in artificial intelligence startups picked up speed in June with several major deals from notable investors, including Andreessen Horowitz, Kleiner Perkins, and Khosla Ventures. In total, $17.781 billion was secured by seven AI startups in June alone.

Here are a few key takeaways

- In the first quarter of 2025, venture capital-backed funding for AI startups dropped by 16.49% to 2,101 deals compared to Q1 of 2024, when at least 2,516 rounds were completed.

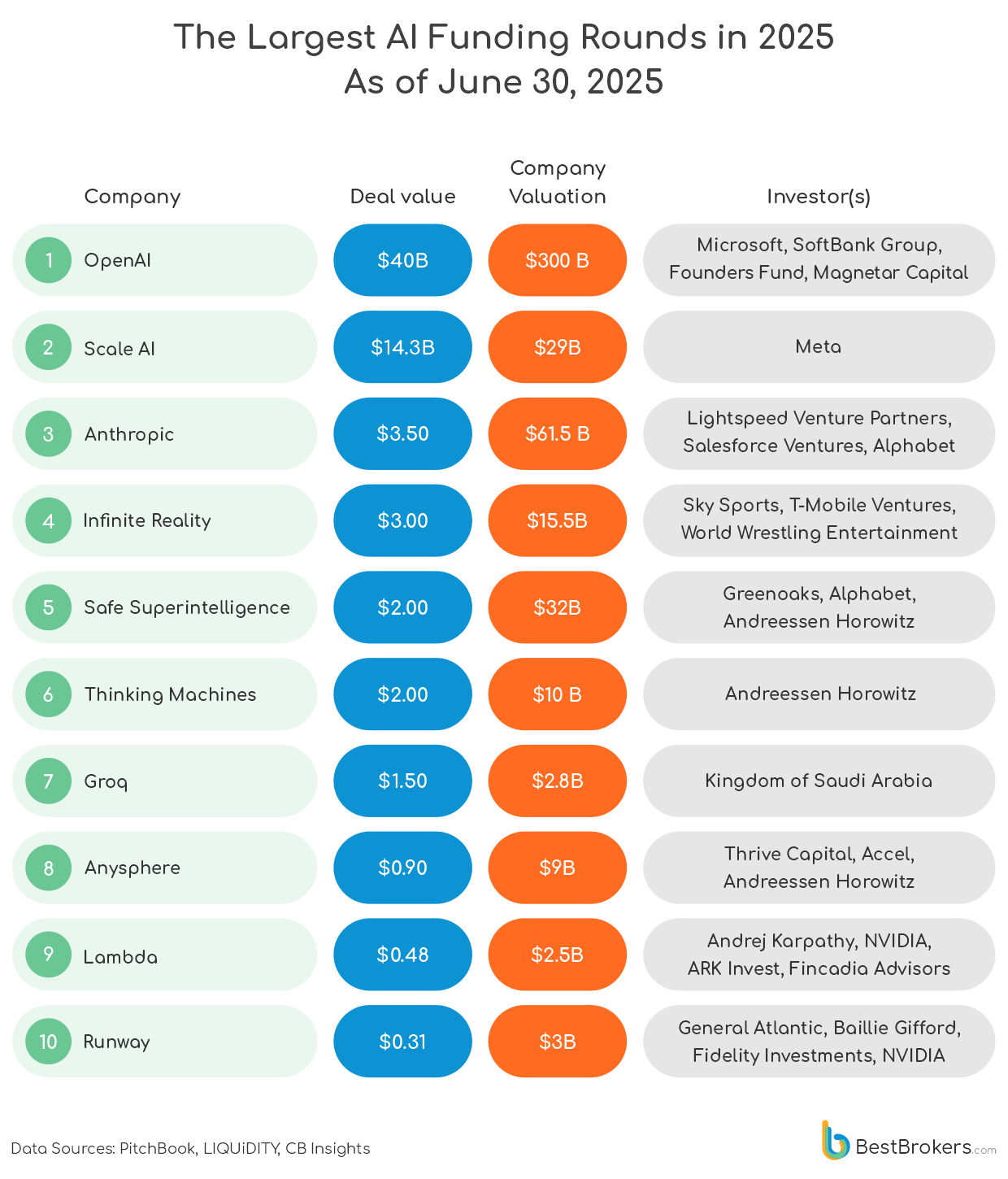

- Among these 2,101 deals, however, were some of the largest funding rounds in the tech sector, including OpenAI, which secured a massive $40-billion funding, raising its valuation to $300 billion.

- While the number of AI-focused deals dropped, their value rose to a record high $73.1 billion in the first quarter, following the massive funding rounds for OpenAI and Anthropic in March.

- In June, Mark Zuckerberg invested $14.3 billion in AI-focused data labelling startup ScaleAI. Meta’s AI ambitions did not end there, with ScaleAI’s CEO Alexandr Wang named Meta’s Chief AI Officer, while the new Meta Superintelligence Labs has talent from some of the best AI companies right now.

- Other major funding rounds securing investment for AI startups this June were Andreessen Horowitz-led $2-billion round for Thinking Machines Lab, and the $600-million round for autonomous vehicles software startup Applied Intuition, which attracted investment by the likes of BlackRock and Kleiner Perkins. Applied Intuition may not be an AI startup (which is why it’s not listed on the table below) but it does work on the technology behind AI-driven vehicles.

Here are the most notable AI-focused funding rounds this June

- ScaleAI (San Francisco, CA) – $14.3 billion investment from Meta; valuation raised to $29 billion

- Thinking Machines (San Francisco, CA) – $2 billion investment from Andreessen Horowitz, Conviction Partners; valuation raised to $10 billion

- Applied Intuition (Mountain View, CA) – $600 million investment from BlackRock, Kleiner Perkins; valuation raised to $15 billion

- Abridge (Pittsburgh, PA) – $300 million investment from Andreessen Horowitz; valuation raised to $5.3 billion

- Harvey (San Francisco, CA) – $300 million investment from Kleiner Perkins, Coatue; valuation raised to $5 billion

- Glean (Palo Alto, CA) – $150 million investment from Wellington Management; valuation raised to $4.6 billion

- Decagon (San Francisco, CA) – $131 million investment from Accel, Andreesen Horowitz; valuation raised to $1.5 billion

More information on Global AI VC deal activity and the sources used can be found in the complete dataset which is available on Google Drive at the following link. Feel free to use any data or graphics by providing a proper link attribution to BestBrokers.com