By Evans Edebor

Intra-African trade has historically struggled—not because of a lack of goods or willing buyers—but due to a complex, costly, and fragmented payment system. At the heart of this challenge lies the overreliance on external currencies like the U.S. dollar to settle transactions between African nations.

RELATED: CBN mandates banks to adopt PAPSS for cross-border African payments

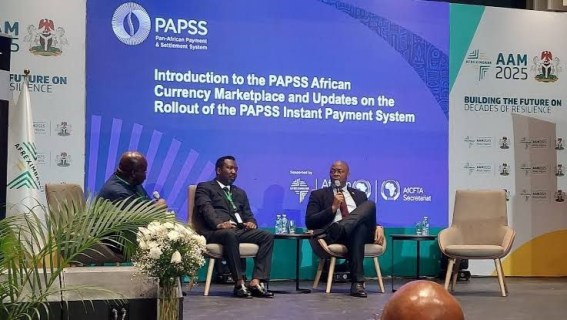

The Pan-African Payment and Settlement System (PAPSS), an Afreximbank-backed initiative, was designed to change this. The original vision was simple yet ambitious: make it possible for Africans to trade with each other using only their local currencies. But despite the dream, the back-end of the system still relied on the very foreign currencies it sought to bypass. That’s where this new chapter begins.

Recognizing the contradiction, PAPSS onboarded Interstellar, a blockchain technology firm, to help design a truly peer-to-peer payment system capable of settling directly in African currencies. Together, they’ve developed a blockchain-based currency marketplace, simulating fiat-pegged stablecoins like the cNGN (crypto Naira) to facilitate local currency transactions across borders.

Here’s how it works: instead of converting local currencies to dollars or euros before completing a trade, this platform allows African businesses and institutions to directly settle in their local units, using digital representations of their currency. In short, it eliminates the need for third-party currencies, enhances liquidity, and restores a degree of sovereignty to Africa’s monetary systems.

The marketplace isn’t theoretical. In fact, before its commercial rollout, Afreximbank piloted the platform in Ghana, Kenya, Nigeria, and Cameroon. Following a successful test, the ecosystem has now grown to include 19 countries as of mid-2025. Notably, major African institutions such as Kenya Airways, Zep Re, and Continental RE are already utilizing the platform to move funds across borders—highlighting a quiet revolution in how money is moved across African economies.

Aa landmark innovation for intra-African trade finance and digital infrastructure. Here are 12 key things to know:

1.) PAPSS has gone blockchain! This new marketplace will enable secure, transparent, and real-time trading of African fiat currencies.

2.) The platform is designed to reduce reliance on foreign correspondent banks, simplifying cross-border transactions.

3,) It solves one of Africa’s biggest trade bottlenecks: currency conversion and access to forex for intra-African payments.

4,) The marketplace connects central banks, commercial banks, and fintechs, enabling them to post buy/sell bids on a trusted digital ledger.

5.) This innovation boosts liquidity in African currencies and reduces costs for businesses and traders.

6.) It adds trust, traceability, and transparency to currency exchange processes through the immutability of blockchain.

7.) By lowering barriers to convertibility, the platform makes it easier for SMEs, women and youth-led businesses to access wider regional markets.

8.) The innovation aligns perfectly with AfCFTA’s goal of seamless intra-African trade and financial integration.

9.) It minimizes dependence on USD or EUR for trade between African countries — saving billions in annual fees.

10.) Blockchain integration makes it harder to manipulate currency trades, encouraging fair competition and stronger governance.

11.) PAPSS now plays a dual role as a payment rail and a currency marketplace, unlocking powerful synergies for trade.

12.) This marketplace will accelerate settlement speed, eliminate time lags in payments, and attract more fintech participation across the continent.

Africa just took another bold leap into the future of finance and trade. With PAPSS leading on infrastructure and innovation, the dream of a borderless, digitally connected Africa is becoming a reality. #AfCFTA is happening — and it’s smarter, faster, and proudly African.

Evans Edebor | Evangelist | Empowering 1 Million Women & Youth-Led MSMEs across Africa by 2035 for AfCFTA Success